7 Important Things to Consider about Pensions When you get Divorced

Pensions can be complicated at the best of times, but add divorce into the mix and things can become even harder to get your head around.

Since pensions are often among the most valuable assets in a divorce, often only bettered by the family home, it’s important to understand how your pension savings may be divided when you get divorced.

Here are seven important things to understand when it comes to dividing your pension savings on divorce.

1. Pensions are considered as joint assets

Many people don’t realise that a pension is considered a joint asset in a marriage. This is the case even when only one spouse has accrued pension savings.

When discussing the division of assets, women are sometimes advised to focus on the marital home, especially when there are children still living at home.

While opting for one of you to take the house while the other takes the pension pot might seem like a good solution, when it comes to retirement, the partner who took the property could find themselves with no income to live on.

If this happens, the person who kept the property may end up having to sell the house to generate the income needed in retirement.

It’s important that both sides consider any pension assets, and that these are distributed fairly.

2. Pensions can often be the biggest asset in a divorce

Pensions are often the second most valuable asset after the family home. Sometimes, pension funds can be worth even more than the house you share. So, make sure you don’t overlook this when discussing settlement arrangements.

Start by getting a valuation for your pension when you’re discussing separation. This must be requested by the member of the pension scheme or the person who set up the pension.

In Scotland, only pension rights built up during the marriage or civil partnership will be regarded as marital assets. But in the rest of the UK, all pension assets are usually treated as marital assets.

A defined benefit pension can be particularly valuable as it is based on how many years you’ve worked and the salary you earned. If either of you have a defined benefit pension, you’ll need to think carefully and plan how it will be split.

Where pensions are involved in your financial settlement, particularly defined benefit pensions, it’s worth getting advice from an expert financial planner. We can help you understand how to split the assets fairly and illustrate how the division of your pension funds will affect your future life plans with cashflow modelling.

3. Many women are reliant on pension income from a partner

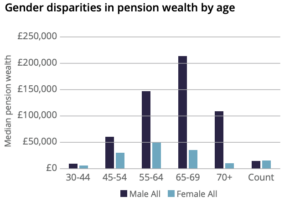

Men have substantially more private pension wealth than women.

A study by the University of Manchester revealed huge gaps in the value of pensions between divorcing men and women.

For those aged 65 to 69, median pension wealth for men is a little over £212,000, but for women it’s only £35,000.

The study also found that married men have the most pension wealth. Married men aged 45 to 54 have median pension wealth of about £86,000 compared with £40,000 for married women. At 55-64, the disparity is £185,000 compared with £55,800.

Co-author of the report and professor of social gerontology at the University of Manchester, Deborah Price told the Guardian: “Divorce is a very emotional time for couples. It is especially difficult for them to think about pensions and often, the person with the larger pension – almost always the husband – does not want their pension to be shared as an asset in divorce.

“Women are often very focused on keeping their homes for themselves and the children and are often prepared to give up quite a lot to secure that.”

“Pensions are also complex and horrible to think about, and if you do think about them, you very often end up needing to pay legal and financial advisers to give you advice, which people don’t want to do. This creates a lot of pressure to ignore the pensions.”

Given the amount of wealth at stake, you need to be certain about decisions you are making when agreeing a settlement. Whatever your circumstances, wherever possible we’ll work with you to help you reach a fair result that safeguards your future.

4. There’s no set formula as to how your assets will be divided

If you end up settling your divorce in court, they’ll seek to achieve fairness. Typically, separating couples start at a 50:50 split, but this may be adjusted if it fails to achieve a fair outcome.

Because each divorce settlement is different, the treatment of any pensions will also vary from case to case. If you and your ex-partner both have your own pensions, they could be ignored entirely.

5. There are 3 main ways pensions can be split

There are three main options for dealing with pensions in a divorce: offsetting their value against other assets, sharing them on a clean break basis, and one partner earmarking some of the income to be paid to their ex-spouse after retirement.

Here are the details for each option:

Offsetting their value against other assets

With offsetting, the value of any pension is offset against the other assets. This means that if a couple owned a property worth £300,000 and a pension worth £300,000, one of you might choose to keep the pension while the other keeps the property.

Offsetting can come with some drawbacks. For the party with the property, it may become necessary to sell in order to generate income to live on in later life. There may also be significant costs for maintaining a property that you may need to take into account.

On the flip side, there are significant tax benefits in owning a pension. Pensions offer tax relief on contributions, and, unlike property, pension funds typically fall outside your estate for Inheritance Tax purposes.

Pension sharing for a clean break

With pension sharing, pension benefit is split and divided between both parties at the time of the divorce.

The partner without the pension will get a share of the pension benefits transferred into their name.

This ensures a clean break as both parties know what proportion of the pension they will receive or keep on divorce.

One partner earmarking some of the income to be paid to an ex-spouse after retirement

Also referred to as a “pensions attachment order”, earmarking allows the partner without the pension to receive income or lump sum payments from it in the future.

Pension benefits are effectively “earmarked” for the other party in retirement. If the pension scheme member dies, the court can order that some or all of any survivor pension or lump sum death benefits be paid to the other partner.

The main drawback of earmarking is that the party without the pension must wait until their ex-spouse retires or dies before they receive any pension benefits. Another problem in opting for this approach is that the recipient of the “earmarked” benefits has no control over the investment decisions their ex- partner takes.

6. You should start topping your pension up after your divorce

If you lose a portion of your pension savings as part of your divorce settlement, it’s important to start saving to make up the difference as soon as possible.

We can help you visualise what the sum lost will mean for you and your retirement plans and create a plan to help you rebuild your retirement savings.

For high earners, Annual Allowances and Lifetime Allowance problems can make this tricky to navigate.

7. Talk to a financial planner and remain on target for retirement

Seeking expert advice and assistance will help you to rebuild your resources and limit the negative effects of giving away a portion of your pension.

With the new flexibilities that pensions can provide, they can be key to creating a great outcome for both parties.

If you have need advice on how to split your assets on divorce, we can help.

To learn more about how we can help you protect your financial interests when you’re getting divorced, or if you want help planning your new future following separation, get in touch. Email hello@firstwealth.co.uk or call 020 7467 2700.

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability