A guide to Enterprise Investment Schemes and Venture Capital Trusts

Enterprise Investment Schemes; one of four ways to invest in small, exciting companies in the UK. Now – in their 30th year – we’ll take you through enterprise investment schemes and its little sibling, the seed enterprise investment scheme, in the beginning of this guide. Shortly followed by Venture Capital Trusts (VCT).

What’s an EIS?

Enterprise investment schemes, known as EISs, are another way to invest in UK companies that have high growth prospects.

They’re not without risk, because only a few firms achieve the heights of success, and you can lose money in those that don’t.

That’s why HMRC offers some punchy tax incentives to entice investors in. We lay these benefits out below.

To answer the question above, an EIS is similar to a fund, in that a human (or an algorithm) selects start-up companies with high growth prospects and which qualify for the scheme.

It’s a similar idea to VCTs, but very different in practice. A VCT is a company, listed on the stock exchange, that itself invests in small companies. In other words, you buy the VCT shares, it then buys the small company shares.

An EIS gives you the investor direct ownership in early-stage company shares. It can be much riskier than a VCT and the returns can be more volatile.

What’s in it for the companies?

It’s not hard to see why a small company with a big idea would go for EIS funding.

A management team can gain access to up to £5 million each year and a maximum of £12 million in their company’s lifespan.

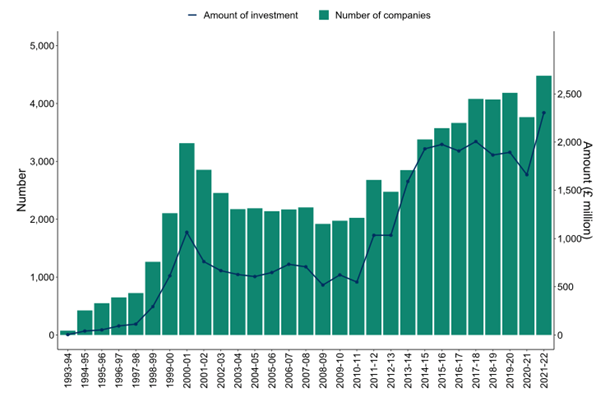

The scheme is popular: the latest data (for tax year 2021-22) say that 4,480 companies raised a total of £2.3 bn under the EIS scheme. These are both record numbers, since EISs were launched back in 1994.

Number of companies raising funds and amount raised, 1993–94 to 2021–22.

It’s reasonable to expect these numbers to grow; applications to join the scheme in 2022-23 exceeded those in the previous year.

Many companies in the scheme are in the technology sector. Altered Carbon is one. It essentially enables computers to smell. Machine Discovery, which helps its clients perform calculations through neural network technology, is another.

But not all, Smarter Naturally creates foods that fight diabetes and high cholesterol, while Osstec builds titanium replacement knees.

The HMRC website includes lots of helpful information for companies looking to use the scheme to raise money.

Why invest in an Enterprise Investment Schemes?

But let’s return to the investment side of the coin. And we’ll start with the tax breaks.

- You get income tax relief of 30%. This is capped at £1m a year.

- But you can raise that cap to £2m by investing in what HMRC call ‘knowledge intensive’ companies – ones with specific intellectual property, carrying out research and development and with a certain proportion of postgraduate-qualified employees.

- You can carry tax relief back to the previous tax year.

- There’s also a capital gains tax (CGT) exemption when you sell EIS shares (provided you claimed income tax relief and held them for three years).

- Exemption from inheritance tax, provided you’ve held the EIS investment(s) for two years.

- Loss relief. Let’s face it, businesses fail, but in an EIS investment you can claw back some of the money you’ve lost, depending on your tax bracket.

These are pretty handy.

There’s also the advantage of allocating money to parts of the economy not covered by shares or bonds. Some investors value this small-company diversity – after all the stock market is dominated by large companies and bonds issued by governments and banks make up the majority of the sector.

And, while we don’t want to overplay the growth opportunities, some companies can do very well.

The little sibling – Seed Enterprise Investment Schemes

We mentioned the seed enterprise investment scheme (SEIS) earlier. This is another way of investing tax-efficiently into small companies.

It was launched in the 2012-13 tax year, as the government sought to build on the success of EISs. It focuses on companies that are less than three years old with less than 25 employees. Many of these are classed as information and communication firms – which took 40% of all investments in 2021-22.

One way to think about the two opportunities is SEISs are for start-ups and EISs for scale-ups.

SEISs offer investors:

- Investment Limit: An individual can invest up to £200,000 each tax year.

- Income tax relief of up to 50%, for shares held for three years.

- No CGT levied upon disposal provided the shares are held for three years.

- Up to 50% CGT reinvestment relief, provided you claimed income tax relief that same year

- 100% inheritance tax relief provided they are held for two years.

- Loss relief on exit, comparable to that of EISs, above.

How to invest

As you might expect, such an established sector is well served by funds. We can’t mention any here because we’ll only ever suggest funds appropriate for your unique circumstances, some opportunities are sector specific, such as technology or the creative industries, while others are linked to universities such as Oxford or Imperial College, London. You can even find passive EIS funds.

The other way of investing is to bypass a fund manager and allocate directly to an individual company or portfolio of companies. But this is the riskier end of something that’s extremely risky in the first place.

And we can’t emphasise that enough. Despite all the tax benefits, the high growth prospects and the excitement that comes with it, this is perilous territory.

If you think an SEIS is for you, we’ll be happy to apply our support and expertise on request.

Venture Capital Trusts; a sector that directed more than £1bn to exciting, fast-growing British companies last year alone. And – according to the latest data – it enabled 19,475 of its investors to claim significant levels of income tax relief. A sector – where investors support innovative young companies with investments in pooled investment trusts. It’s high risk, but potentially offering high returns.

What’s a Venture Capital Trust (VCT)?

Venture capital trusts, known as VCTs, are one of several ways to support small British companies with high growth prospects in return for handsome tax relief.

A VCT is a type of fund, managed by a fund manager, that builds a portfolio of suitable companies to spread risk and diversify your returns.

Many of these companies are in the technology sector. Yardlink is one. It digitises construction sector procurement, to speed up processes and reduce costs. VCT funding enabled the firm to double its headcount in 2022.

Other investments are more traditional. Pure Pet Food’s founders came up with the idea of personalised dog food. Yet they turned down money from the BBC TV Dragons in favour of a VCT investment, which helped them to generate a 15x increase in revenue.

Diversification

There are several reasons why VCTs tend to appeal to First Wealth clients. One is the opportunity to diversify into parts of the economy the stock market cannot reach. Companies who wish to list on the latter need at least £30m in market capitalisation.

That’s a sum of money that excludes most of the 5.5m businesses in the UK. So, if you want access to, say, construction technology companies or entrepreneurs playing the growing trend in personalised pet food, VCTs are one of a limited number of options.

Supporting the economy

Moreover, in an era where stock markets remain globalised – and ‘British’ firms like JD Sports make more money from overseas than home markets – investing in a VCT puts money into UK companies that want to grow and create jobs.

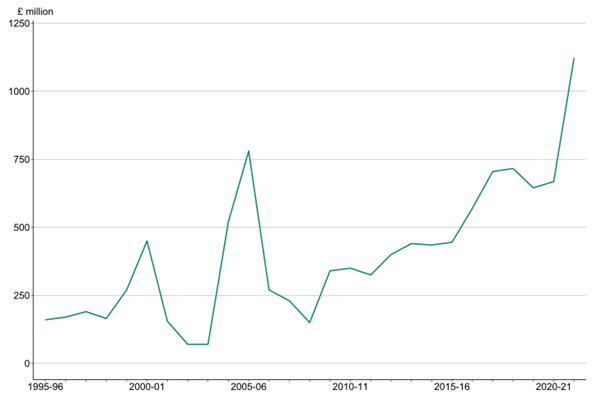

In fact, companies supported by VCTs employ some 92,000 people, up by a third since 2021. And, at the same time, the VCTs have been investing more and more in qualifying companies.

Source: Amount of funds raised by VCTs (£ million), 1995-96 to 2021-22.

Impressive tax relief

But, let’s face it, one of the main reasons we’re talking VCTs is the tax relief available. And it’s not loose change – these are serious numbers.

If you invest up to £200,000 a year in VCTs you qualify for three types of tax relief:

- Income Tax Relief – individual shareholders aged 18 or over can claim this relief at the rate of 30% of up to £200,000 annual investment, provided their shares are held for at least five years.

- Dividends – no income tax is payable on dividends from ordinary shares in VCTs.

- Capital Gains Tax – no CGT is payable on disposals by individuals of ordinary shares in VCTs.

These are available to individuals and not to trustees, companies or others who invest in VCTs. But we can easily discuss the optimal way to structure your investments.

Choosing a VCT

If this sounds attractive, you’re not alone – more than 19,000 people supported small companies through VCTs in the 2021-21 tax year.

But you should know there are different types of VCT, and each brings different characteristics.

The first are generalist VCTs. These are industry and sector agnostic. The fund manager will seek to create a balance of different types of companies, at different stages, to spread risk.

Next come specialist VCTs. These focus on a single industry or sector. Technology is a popular segment, perhaps for obvious reasons, but you can also find trusts specialising in healthcare or infrastructure opportunities.

And then there are AIM VCTs. They allocate solely to companies listed on the Alternative Investment Market – the junior sibling to the main market of the London Stock Exchange. This means the underlying companies will have shares with a daily price and they are more liquid, and therefore easier to buy and sell.

VCTs often appeal to those at the start of their entrepreneurial journey – where your wealth is allocated to like-minded stars of tomorrow. It’s also attractive to clients with retirement in mind – because the remarkable tax relief is a handy complement to the tax incentives on pensions.

This is of course higher risk investing. Smaller companies face greater risks than, say, much larger ones – and you may not get back the full amount you invest.

But whichever your stage of the journey, we’d be delighted to discuss whether VCTs might be suitable for you and your personal and business finances.

[1] https://www.gov.uk/guidance/venture-capital-schemes-raise-money-by-offering-tax-reliefs-to-investors#social-investment-tax-relief-sitr

[2] https://www.gov.uk/government/statistics/enterprise-investment-scheme-seed-enterprise-investment-scheme-and-social-investment-tax-relief-may-2023/enterprise-investment-scheme-seed-enterprise-investment-scheme-and-social-investment-tax-relief-statistics-2023

[3] https://www.gov.uk/government/statistics/enterprise-investment-scheme-seed-enterprise-investment-scheme-and-social-investment-tax-relief-may-2023/enterprise-investment-scheme-seed-enterprise-investment-scheme-and-social-investment-tax-relief-statistics-2023#enterprise-investment-scheme-eis

[4] https://altered-carbon.com/

[5] https://machine-discovery.com/

[6] https://smarternaturally.com/

[8] https://www.gov.uk/guidance/venture-capital-schemes-apply-for-the-enterprise-investment-scheme

[9] https://www.gov.uk/government/statistics/enterprise-investment-scheme-seed-enterprise-investment-scheme-and-social-investment-tax-relief-may-2023/enterprise-investment-scheme-seed-enterprise-investment-scheme-and-social-investment-tax-relief-statistics-2023#enterprise-investment-scheme-eis

[10] https://static1.squarespace.com/static/5a8c0ea44c0dbff0a1a83d64/t/6554ef5ddebf6260aedca22b/1700065120266/VTCA+Report+Igniting+the+Spirit+of+Growth%2C+Innovation+and+Success+in+the+UK+v4.pdf

[11] https://www.gov.uk/government/statistics/venture-capital-trusts-2022/venture-capital-trusts-statistics-2022

[12] https://static1.squarespace.com/static/5a8c0ea44c0dbff0a1a83d64/t/6554ef5ddebf6260aedca22b/1700065120266/VTCA+Report+Igniting+the+Spirit+of+Growth%2C+Innovation+and+Success+in+the+UK+v4.pdf

[13] https://static1.squarespace.com/static/5a8c0ea44c0dbff0a1a83d64/t/6554ef5ddebf6260aedca22b/1700065120266/VTCA+Report+Igniting+the+Spirit+of+Growth%2C+Innovation+and+Success+in+the+UK+v4.pdf

[14] https://www.fca.org.uk/news/press-releases/fca-confirms-new-listing-rules-boost-growth-and-innovation

[15] https://www.money.co.uk/business/business-statistics#:~:text=How%20many%20businesses%20are%20there,82%2C000)%20from%20the%20previous%20year.

[16] https://www.jdplc.com/sites/jd-sportsfashion-plc/files/2023-05/jd-fy-results-presentation-23.pdf

[17] https://static1.squarespace.com/static/5a8c0ea44c0dbff0a1a83d64/t/6554ef5ddebf6260aedca22b/1700065120266/VTCA+Report+Igniting+the+Spirit+of+Growth%2C+Innovation+and+Success+in+the+UK+v4.pdf

[18] https://www.gov.uk/government/statistics/venture-capital-trusts-2022/venture-capital-trusts-statistics-2022

[19] https://www.gov.uk/government/statistics/venture-capital-trusts-2022/venture-capital-trusts-statistics-2022#investors-claiming-income-tax-relief-and-amounts-invested

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability