Can buy-to-let property still be a good home for your money?

Investing in buy-to-let property was once a popular choice for those wanting to diversify their savings. But tax changes, tighter regulations, and lending restrictions have made life harder for landlords.

Owning a property that you rent out is now more time-consuming and expensive. And the UK government isn’t afraid to change the rules to squeeze more tax out of private landlords either.

Buy-to-let investors are becoming increasingly disillusioned

This is Money reported that 71% of landlords “felt the government had unfairly targeted buy-to-let on tax and new regulations”.

The same report suggested that, in 2020 alone, 44% of investors intended to sell one or more of their properties.

How has buy-to-let changed?

The government has made various tax changes affecting buy-to-let landlords over recent years.

First, in 2016, there was a 3% surcharge in stamp duty on additional properties, such as buy-to-lets and second homes.

Second, the government has been reducing mortgage interest relief since 2017. Previously, landlords could deduct the interest they paid on their mortgage before paying tax. In effect, this deduction gave higher-rate taxpayers 40% tax relief on their mortgage payments.

Now landlords are given a flat-rate tax credit based on 20% of their mortgage interest.

If you’re a higher or additional rate taxpayer, this will almost certainly have a negative impact on the money you can make as a private landlord.

You may find it harder to make money

These tax changes now mean that you may find it harder to make money. And if you were considering buy-to-let property as an alternative to having a pension, the tax rules may make you rethink your plans.

To illustrate the painful cost of the changes, if you invest £75,000 into buying a £300,000 property, HMRC will take £9,000 in stamp duty.

However, if you pay £75,000 into a pension, basic-rate tax relief tops it up by an extra £18,750. And if you’re a higher- or additional rate taxpayer, the tax benefits increase even further.

Unless you are contributing to your pension through carry forward, the £40,000 annual allowance would mean you’d have to pay the £75,000 into your pension over a couple of years. Even so, the sums would remain the same.

Most buy-to-let mortgages are interest-only arrangements. If you’re a higher-rate taxpayer with an interest-only mortgage on your buy-to-let property, you’ll find the tax changes make quite a dent in your potential profits.

The table below shows how the tax picture has changed for a landlord paying £500 a month in mortgage interest and earning £1,000 a month in rent.

Source: Unbiased

You’re also subject to Capital Gains Tax when you sell

Unfortunately, the tax charges don’t end with Stamp Duty and mortgage interest tax. You also have to pay Capital Gains Tax (CGT) when you sell your buy-to-let property.

The rate at which you’ll have to pay CGT depends on your taxable income. If you’re a basic-rate taxpayer, the rate is 18%, while higher-rate taxpayers pay 28%.

The good news is that there is an annual exemption for CGT. This is currently £12,300* (2021/22).

So, if you bought a rental property 10 years ago for £100,000 and sold it today for £150,000, your capital gain would be £50,000. Of this, £37,700 would be taxable, after your CGT allowance has been deducted.

Assuming no other tax reliefs, your CGT bill on this transaction would be £6,786 (if you’re a basic-rate taxpayer) or £10,556 (if you’re a higher-rate taxpayer).

*The annual exempt amount will fall from £12,300 to £6,000 in 2023, and to £3,000 in 2024.

Setting up a limited company could help you cut costs

The thought of having to pay so much extra tax can be off-putting, but purchasing buy-to-let property through a limited company can make the sums more palatable.

By owning property through a company, the costs can be deducted as business expenses. This includes mortgage interest payments.

With a limited company, you can draw income as dividends. In the tax year 2021/22, the first £2,000 of dividends is tax-free. After that you’ll pay tax on further withdrawals at:

- 5% if you’re a basic-rate taxpayer

- 5% if you’re a high-rate taxpayer

- 1% if you’re an additional-rate taxpayer.

You also need to consider that your limited company will have to pay Corporation Tax on profits, with the rate of Corporation Tax being 19% (2021/22).

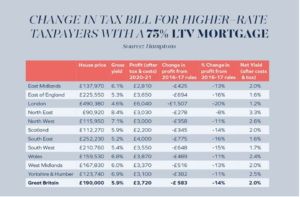

London landlords have seen profits fall by 20% in four years

According to Hamptons, the average higher-rate taxpayer landlord with property in London has seen their profit fall by 20% in four years to £6,040 a year.

Source: Hamptons

Ways you can make your money work harder

Buy-to-let property has many potential benefits for investors. Rental property can provide a regular source of income and give you potential long-term yield from any increase in the property’s value. But it also comes with high-maintenance issues and a heavy tax burden.

Tying your money up in property may not be ideal either. You’re effectively locking your money away for a long period and it is hard to release cash from the investment unless you remortgage or sell the property.

If all of this makes you think again about investing in property, here’s a selection of alternative opportunities that may be worth considering.

Real-estate investment funds

If you still want to invest in property minus the high-maintenance issues, consider investing in estate investment funds. By pooling your funds with others, you can invest in commercial properties through investment companies trading in public markets.

Remember, these are long-term investments and, for a chance to gain the best returns, you’ll need to be comfortable locking your money away for several years. However, investing through a property fund is more liquid that direct property ownership.

Bonds

Bonds are a relatively stable, low-risk form of investment, although some are considered riskier than others. Bonds are essentially loans made by the investor to a borrower (often a government or large organisation) and are repaid over a set period of time at a fixed rate of interest.

With different length bonds, you can choose how long you want to leave your money tied up – from one year up to 10 years.

Shares

If you invest in shares, make sure you’re prepared to leave your money invested for at least five years, and preferably longer, to get the best return on your money. Shares can be volatile and can fall as well as rise in value.

At First Wealth, we take an evidence-based approach to investments. By spreading your investments across the world’s best companies and global bonds, you can diversify risk and reduce fees.

Get in touch

If you’re interested in finding out more about whether investing in property is appropriate for your long-term financial goals and wish to discuss all your options, get in touch. Email hello@firstwealth.co.uk or call 020 7467 2700.

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability