Do you have the right team for your growth business?

Great teams can achieve great things. Especially when the chips are down. For entrepreneurs, at a time when start-up funding has plummeted, it’s more important than ever to get the right people, with the right skills, by your side. The long-term future looks especially rosy for tech companies, but getting through this current sticky patch could be crucial.

Funding is down

There’s a fifth less money available for UK start-ups at the moment. That’s the chief finding from recent research by data specialist Traxcn. In such an environment it’s more important than ever to get the right team around you – including financial advice.

Behind this worrying headline we find that:

- British start-ups raised 19% less money in Q1 2024, compared to Q4 2023

- Late-stage start-ups were hit hardest, receiving 33% less funding

- Early-stage start-ups saw just a 7% drop on the previous quarter (but a 24% fall compared to Q1 2023)

- Seed investments rose 12% quarter on-quarter, but fell 27% year-on-year

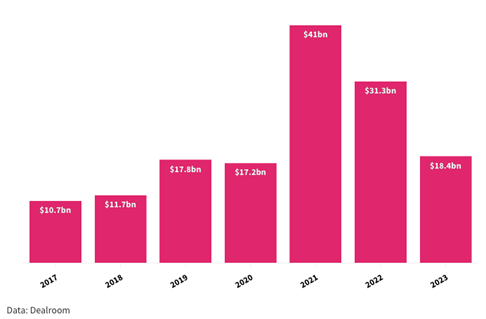

The data follow a general worsening in the funding environment for technology companies (not just start-ups), over the last couple of years, as this chart shows.

Start-ups are up

At the same time, the number of companies being registered is on the up. Even if the overall number of business is falling, slightly.

What to make of this data?

We’ve been advising start-ups and entrepreneurs for years and it seems clear there are two things going on.

Firstly, the business environment has undoubtedly been difficult and will probably continue to be so over the short term. That’s not just an anecdotal assessment. Business confidence is down more broadly compared with pre-pandemic levels.

But it won’t last forever because, secondly, there is tremendous cultural, political and economic support for start-ups in the UK – especially tech ones.

The Government’s science and technology secretary recently outlined plans for UK to be “the powerhouse of growth.” These include easier listing rules, flexible regulation and the promise of £1bn in investment.

Because, after all, the UK is pretty much powered by start-ups. According to the government, the tech sector is worth over $1trillion, employs 1.8 million people and the UK has by far the most unicorns (start-ups that achieve a $1bn valuation) in Europe.

Building the right team

So, the promise of support is there, if only companies can get through these difficult conditions.

One survival criterion is getting the right money team in place.

The core of your money team is your close friends and family: people who know you, and your strengths and weaknesses almost inside out.

We then help you build out the team in the right directions – with professionals for specific counsel, pertinent questions and compelling answers. These are financial planners, lawyers and accountants.

They help identify your blind spots and build your confidence when you take opportunities from day one. The financial planner especially can help you with improved financial security while you scale and grow your business.

Navigating towards success

We are of course entrepreneurs and business owners ourselves. And we understand that your personal finances and your commercial finances are a delicate balancing act – especially at the earlier stages of business growth.

And especially when business funding is scarce, as it is now.

So, what we do is provide a three-step plan: we get to know you, your life, your family, your business and your long-term goals; we build a plan based on where you are right now and that propels you towards your financial objectives; and then we work with you throughout the journey to keep you on track.

It can be easy to neglect your own finances for those periods when work is your life. If you’re an entrepreneur and you want to talk about that delicate balancing act between personal and business finances, we’re here to help. Please get in touch on hello@firstwealth.co.uk or call 020 7467 2700.

[1] https://www.digit.fyi/uk-startup-funding-down-by-a-fifth-in-q1-2024/

[2][2] https://sifted.eu/articles/uk-tech-in-2023-review

[3] https://www.ons.gov.uk/businessindustryandtrade/business/activitysizeandlocation/bulletins/businessdemographyquarterlyexperimentalstatisticsuk/octobertodecember2023

[4] https://www.ons.gov.uk/businessindustryandtrade/business/activitysizeandlocation/bulletins/ukbusinessactivitysizeandlocation/2023

[5] https://www.icaew.com/technical/economy/business-confidence-monitor/business-confidence-monitor-national

[6][6] https://www.gov.uk/government/speeches/science-innovation-and-technology-secretary-michelle-donelans-speech-at-plexal

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability