Everything you need to know about Employee Ownership Trusts

Several of our clients have used Employee Ownership Trusts (EOT) to exit their business in recent months.

Since many more business owners could benefit from using EOTs to reduce potentially heavy tax charges, I thought it would be useful to share with you what an EOT is, how it works, and some of its benefits and drawbacks.

What is an “Employee Ownership Trust”?

Introduced by the government in 2014, an EOT is a form of employee benefit trust. The intention was to encourage more shareholders to establish corporate structures similar to the John Lewis model, where every employee owns a share of the company.

The major incentive for business owners is generous tax breaks.

When business owners sell their shares to an EOT, they can do so without paying Capital Gains Tax (CGT). However, to qualify for the tax incentives, employee ownership must be structured in a particular way.

Helpfully, partnerships can also benefit from using an EOT to exit the business since the shareholders, or former partners in this instance can also sell their shares to an EOT.

Criteria for moving to an EOT model

To open an EOT, there are certain criteria you must meet:

- The company shares being transferred must be for a trading company or the main company of a trading group

- All employees must benefit from the EOT. However, any employees in the business who already hold 5% or more of the share capital in the business at the time the trust is set up cannot benefit from the scheme.

- The trustees must retain at least a 51% controlling interest in the company

- The tax reliefs are subject to these conditions, in particular, the 51% controlling ownership.

The criteria above are ongoing conditions, an EOT may also be disqualified if:

- The company stops trading

- The EOT fails to meet all of the employee benefits or controlling interest requirements

- A breach of the limited participation requirement

- The trustees fail to follow the rule of equality.

Setting up and managing an EOT

While there are obvious benefits of an EOT, especially from a tax perspective, the decision to become an employee-owned company shouldn’t be taken lightly.

Changing an ownership structure is a fundamental change and business owners should have compelling reasons for making the change. Because the trustees of the EOT must act in the long-term interest of all employees, once a company has become majority owned by an EOT, it’s not easy to reverse the structure.

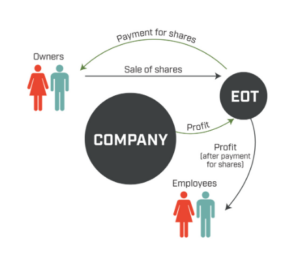

How an EOT is structured and funded

When setting up an EOT, funding is needed for the purchase of shares from the existing owners. The vendor will often be paid for their shares in instalments from future income generated by the company.

In some cases, it may be possible to arrange an external loan, which will enable the purchase price (or a significant part of it) to be paid in one go.

An EOT is run by its trustees. While the management of the company continues to be handled by the management team, the EOT trustees’ role is to ensure the company is well led. Their role will not be to manage the company (this continues to be the management team’s role) but to ensure the company is being well led and encourages employee engagement and commitment.

The benefits of using an EOT

There are multiple benefits for business owners using an EOT. Along with the tax breaks, there are also short-term wins and long-term gains to consider.

Short-term benefits

- Allows an exit where there’s no obvious third party purchaser

- Can provide a quick exit route for shareholders

- Allows a tax-free disposal by UK individual shareholders

- Owner can retain some involvement (up to 49%)

- Share capital is still available to incentivise management and key employees.

Long-term benefits

- Can help align the goals of stakeholders and employees

- Improves employee retention and morale

- Encourages innovation at all levels

- Improved business performance by driving the growth of stakeholder values

- Employee ownership encourages employee engagement.

Tax benefits

- For business owners, disposals into the trust can be made free from Capital Gains Tax (CGT) and Inheritance Tax (IHT).

- For the employee, the EOT can pay annual bonuses, up to £3,600, free of Income Tax.

- The company will benefit from a deduction in Corporation Tax for the value of the bonuses.

Drawbacks of using an EOT

Of course, there are some disadvantages and tax consequences that need to be considered:

- The EOT will have to pay Stamp Duty on the transfer of shares, equal to 0.5% of the value of the shares transferred.

- Because the purchase price is fixed at the point of sale, the selling shareholders won’t benefit from any increase in value after the sale, unless they retain some shares or are granted share options.

- The shareholders may receive relatively little upfront cash for the sale of their shares because the sale is, usually, mainly on deferred consideration terms.

Get in touch

While Employee Ownership Trusts won’t be right for every business, they can be a useful solution for owners looking to retire or establish a succession plan.

If you’re interested in finding out more about exiting your business and want to discuss whether an Employee Ownership Trust could be right for you, get in touch. Email hello@firstwealth.co.uk, book a video call, or phone us on 020 7467 2700.

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability