How to improve business resilience and manage risks

Business resilience. It’s a phrase often bandied around. But what does it mean – and, more importantly, how can you get it for your enterprise? Here we look at the importance of resilience some characteristics of resilient organisations and suggest ways of helping you get more resilient.

Human, all too human

There’s something very human about setting up on your own.

But, that commonality aside, people launch a business or enterprise for all sorts of different reasons. You might be convinced of the brilliance of your idea. Working for someone else might not be suitable for you anymore. You may want to build something that’s your own for the long term. Or maybe it’s the post-retirement side hustle.

Becoming a business owner can be infinitely rewarding, but only if you go about every aspect of it the right way – from day one to the day you sell up, retire, or move on to the next challenge.

There may be trouble ahead

Doing everything in the right way can be pretty hard to do these days. Many of the entrepreneurs we’re speaking to at the moment comment on flat and challenging business conditions.

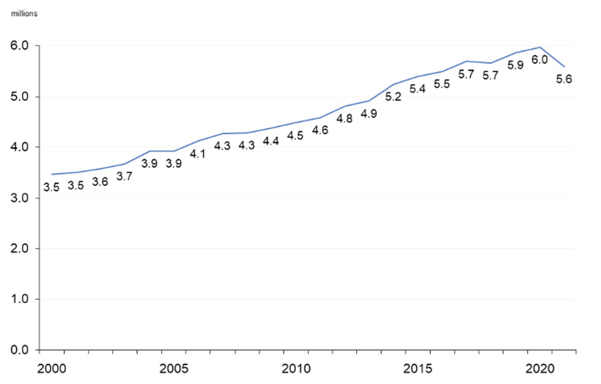

Government statistics tell the same story. For example, between 2020 and 2021, the total business population decreased by 390,000 (6.5%)[1]. The below chart shows the way in which UK private sector businesses in that period have tailed off.[2]

Chart: The number of private sector businesses in the UK, 2000 to 2021

The data for 2022 is due to be published fairly soon – but, with challenging business conditions, a cost-of-living crisis, low levels of international trade (with non-EU exports yet to meaningfully outstrip EU exports[3]), and claims the UK is already in recession[4], it’s reasonable to expect more of the same.

The importance of resilience

This is a time for resilience.

Business resilience is an organisation’s ability to absorb stress or pressure; maintain or recover its critical functions in; and prosper in unexpected or adverse conditions.

Interestingly, in an era when almost everything is measured – from an organisation’s share price to the penetration of its brand in a given demographic – there is no accepted metric for resilience.

Instead, the inference is that you either have resilience … or you don’t.

Just to avoid any doubt, I cannot stress enough how important it is to have resilience. I’m not alone: the esteemed Boston Consulting Group argue that organisational resilience is more important than efficiency[5].

Planning for business resilience

Your business resilience starts with planning.

We work with some of the most impressive entrepreneurs in the UK, with great ideas and endless drive. When they first come to us, not all of them have plans.

Every new business needs a realistic plan – with the flexibility to be refined or adapted when it’s put to the test in the real world. Sitting down and plotting out a short-, medium-, and long-term view of where the business will go is a valuable and insightful exercise.

It sets a direction of travel, flags up potential problems, and establishes sequential success metrics.

Six characteristics of resilient organisations

When implementing your plan – and experiencing the thrill of managing your business – it is worth considering factors that can boost resilience. Here are six.

- Systems and processes with a degree of in-built redundancy can absorb shocks more easily than those operating at full capacity.

- Contingency planning – such as scenario analysis or monitoring market or regulatory conditions – works on the principle that if something negative could plausibly happen, it will.

- A workforce that is diverse across multiple metrics – from socio economic background to neurodivergence – will be well placed to think laterally and assess and mitigate risks.

- Structuring a company on a modular basis will allow one part to fail without bringing the whole house down.

- An organisation with purpose that is well aligned to social or economic needs is more likely to bend to an opposing wind than break against it.

- A flexible enterprise, that is capable of variance and iteration, will be more capable of scaling up those ideas with the greatest traction.

The money team

But no-one’s going to get anywhere near resilience without the right expertise in place.

That’s why we encourage our entrepreneur clients to assemble the ‘money team’.

These aren’t your staff. An effective money team starts with the people who know you, and your strengths and weaknesses in detail: your friends and family.

Then we help you pull in the professionals you need to keep your enterprise flying. These are a great financial planner, an accountant and a lawyer to make sure that everything is set up and working correctly from the beginning.

A money team should challenge you; they should cover gaps in your knowledge and experience, and

help you identify opportunities or risks you may not have spotted.

It’s also incredibly important that they can work together. You’re a business owner, out there making things happen in your own world, you shouldn’t be chasing around trying to organise your accountants or lawyers; a great financial planner should not only be a part of the ‘money team’, they should also be the heartbeat – interacting with the other parts on your behalf.

We believe that with the right financial planner on your team, you should be well-equipped to get the balance between work and life finances correct. This is something we have vast experience in.

[1] https://www.gov.uk/government/statistics/business-population-estimates-2021/business-population-estimates-for-the-uk-and-regions-2021-statistical-release-html

[2] https://www.gov.uk/government/statistics/business-population-estimates-2021/business-population-estimates-for-the-uk-and-regions-2021-statistical-release-html

[3] https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/bulletins/uktrade/august2023

[4] https://www.niesr.ac.uk/publications/uk-economy-in-recession?type=gdp-trackers

[5] https://www.bcg.com/publications/2020/resilience-more-important-than-efficiency

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability