How to invest in 2023?

There is a very positive case for investing in 2023. It might require patience and a willingness to hold one’s nerve. But, for anyone with a long-term view, the rewards are on offer.

If your hopes for the year ahead are low, you’re not alone.

UK consumer confidence sits at record lows[i]. A group of leading economists wished everyone a happy new year by predicting a “miserable” 2023[ii]. And, as you read this, rain is probably hammering at the window.

Emotion versus evidence

But here’s the thing. History suggests you – and your wealth – are very likely to be okay.

The emotions we attach to our investments, our property, our tax liabilities, and our perceptions of financial wellbeing can sometimes be misleading.

The things we observe, discuss, or ‘feel’ in our daily experience all influence our financial decision making – dragging it away from empirical fact.

Like right now. Both investment and property markets have become choppy, behaving in ways we might not have expected.

The FTSE 100 has in recent years offered investors troughs and peaks that might faze seasoned polar explorers. Bond markets remain bruised by high and rising interest rates. Inflation is eating cash.

Moreover, UK house prices have also struggled to keep abreast of inflation in recent months[iii].

And yet, anyone with a well-positioned portfolio should have no reason to be unduly worried.

Moreover, anyone with a portfolio that has room for improvement should also have good reason to be optimistic.

Don’t worry…

You have two valuable commodities on your side.

We don’t mean copper, or coffee, or gold – though we’ll come back to the problem with gold later on.

We’re talking history and time.

History is an excellent reference point for the prospects of any wealth portfolio. That’s because, for about 75% of the time, stock markets go up.

Here’s some research from one the world’s largest and most successful money management companies, an American firm called Vanguard.

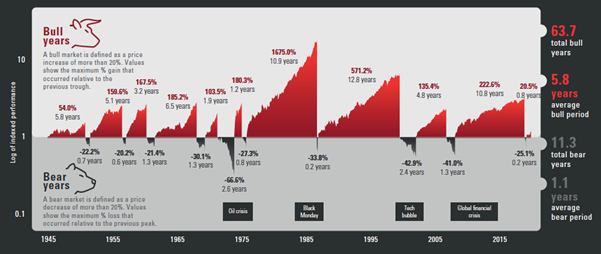

What you’re seeing is that, over a 75-year period, anyone invested in this market would have made money in more than 63 of them. While instances of loss are always sharp and sudden, they are also short and small.

Moreover, if you invest when the market is going down, your journey to the top will be all the longer (and more profitable). Investing in a falling market is rarely easy. But this is where evidence trumps emotion. And evidence can build wealth.

Time is also valuable. The above chart also shows that if you put money in, at just about any arbitrary point, and hold it for at least five years, you achieve a positive return.

There is an old saying among professional investors that is hard to disagree with: time in the market is more valuable than timing the market.

… be happy

Financial happiness – or financial wellbeing – is one of those things people rarely talk about. But it’s also the thing we all want.

One way we think about happiness – especially in 2023 – is to focus on control.

There are some things that can be controlled in quite a straightforward and simple way. These include reducing costs associated with your wealth, your tax liability and also the way you behave in difficult market conditions or to unwanted news.

No one can control investment or property markets. Even the Bank of England struggles.

But you can make the most of opportunities within that, to minimise the impact of limited control. Four things we’re thinking about in 2023 are:

- Investing in smaller companies as opposed to larger ones. The former are nimbler, they’re led by hungrier management teams, they usually want to change the world. And, while nothing is ever guaranteed, they frequently deliver returns to their shareholders.

- Moving some wealth towards overseas assets. Global investing can build wealth efficiently. By way of contrast, investing in companies you see on the local high street has some appeal – but it’s not always supported by the evidence.

- Looking for value. Like a shopper in a sale, buying an investment at a price below what it should ‘normally’ be is a canny, and profitable, course of action. There are plenty of these around in January and, we expect, throughout the year.

- Passive has historically beaten active over time. Again, there are obviously advantages and disadvantages to both. The siren call of the ‘star’ investor is almost always beguiling. But, as you might have guessed, unsupported by evidence. This year, as in other years, we will direct clients towards lower cost products that match the market – and avoid expensive ones that aim high, but all too often fall short.

And what we are not going to do is recommend gold. Here’s why: if you’d bought £1 of gold back in 1945, it’d be worth around £1,800 now. Put that £1 the US stock market and you’d have some £38,000. Despite this, evidence always wins, so if the evidence ever changed, we might consider it.

In a year where bad news is likely to dominate, and when sentiment will probably take a turn for the worse, we’ll be getting our clients’ wealth allocated correctly – and encouraging them to sit tight.

[i] https://www.ft.com/content/d074c31c-1f14-43c1-9ae4-320fa7b854f8

[ii] https://www.ft.com/content/955b568a-c924-421a-bc0f-caa85d37007b

[iii] https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/l55o/mm23 and https://www.gov.uk/government/statistics/uk-house-price-index-for-september-2022/uk-house-price-index-summary-september-2022

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability