How to invest your bonus while being tax efficient

Bonus season is here. Whether you get what you want or not, there’s always room to plan, especially if you want to avoid a nasty tax surprise.

What did you do with your first bonus?

When it comes to bonuses, a good rule of thumb is to spend about 30% and save the remaining 70%. Although, let’s face it, first time round, you can be forgiven for splurging the whole lot on something you’ve always wanted.

In fact, there’s nothing quite like the feeling you can get on bonus day. Elation. Satisfaction. Vindication. All this, and a whole lot more.

This year though – according to Financial Times research – bonus season is likely to be muted. So, while people in, say, gas and oil might be in line for bumper pay-outs, others are saying the real bonus is having a job at all.

Whichever category you might fall into, it is best to have a plan in place so you can prepare for any nasty tax surprises.

Spend, spend, … invest

Last year, when people spent, they chose to direct big pay-outs towards home improvements or even trading up. They also splashed out on the sort of holidays we all yearned for during lockdown.

But most people used most of their bonuses to pay off debt, especially mortgages, and invest for the long term.

Early estimates are saying that this year, we will see a trend towards debt repayments and investments taking the lion share of bonus pay-outs. And, from speaking with clients, such decisions are all part of the plan.

Safety first

Clearly, every client is different – that is what makes this profession so interesting – but many of those who get the best financial and mental returns, often start by covering their basics first.

This usually means paying off any unsecured debts as soon as possible – especially if their interest rates sit at 10%+.

It also means setting up an easy access account with enough money to cover about six months’ worth of expenses to provide yourself with an emergency fund.

These pay out more than they used to, thanks to higher interest rates, but accessibility is the main thing. It’s no use having a fabulous rate of return if you can’t get the money in an emergency.

Saving the 70%

Whether you set aside 70% of your pot – or more, or less – it’s worth thinking about your short and long-term goals.

A good example of the former might be school or university fees, a wedding or other family commitments. The latter tends to point towards retirement and inheritance. In other words, making sure you set aside enough for the sort of lifestyles you’d like for yourself (post-work) and your family (post-death).

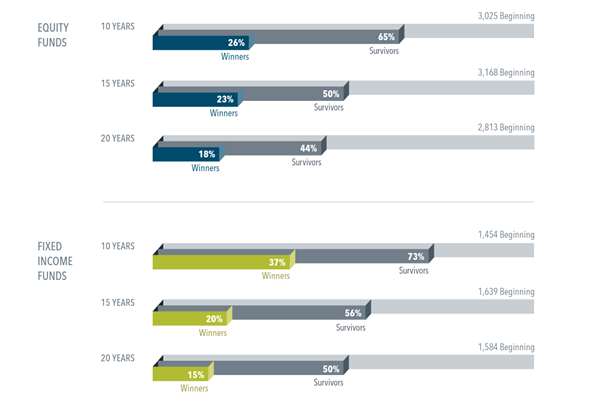

The SPIVA (S&P Indices Versus Active) Scorecard evidenced that professional fund managers consistently underperform the benchmarks of their respective markets over both short and long-term periods. As shown below, SPIVA concluded that few funds survived or outperformed their markets in the period ending December 2021:

So if you decide to save that 70%, and invest it, you should consider passive funds.

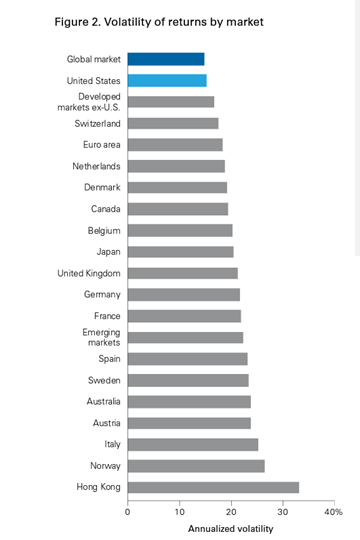

You may also improve your returns if you tilt your money towards smaller companies and those in emerging markets. This will help to mitigate any specific market falls, giving you a cushion of protection when you see your investments starting to fall in one area or another. Though, this can be complex; always seek advice before making your decision.

This possibility of improved returns was shown in Vanguard research on market volatility, where the Global market had the least annualised volatility:

Tax shocker

Unfortunately, receiving a large bonus can put you into a higher tax bracket.

A number of people who contact us for the first time do so because they need guidance in this unique situation… It is far better to plan in advance so that you can reduce these potential tax liabilities before they happen. It will save you quite a bit of last minute stress.

One way to reduce the impact is to pay some of the bonus directly into your pension via salary sacrifice. This saves you National Insurance and income tax. It will also boost your pension at the same time.

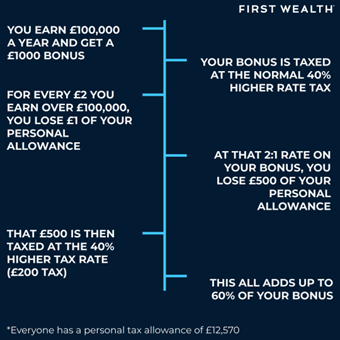

If your bonus pushes annual earnings over £100,000, your personal tax allowance will start to taper down – for every extra £2 you earn over that threshold – and you could end up paying up to 60% tax on some of that income!

That sounds confusing, so let’s break it down:

A quick win, which works well with our clients, is to make a personal pension contribution. Let’s say you have a £10,000 bonus that takes taxable income up to £110,000. If you pay that £10,000 gross into your pension, you won’t enter that (unofficial) 60% tax zone and you’ll get the benefit of a 40% top-up on your contribution, thanks to pension tax relief.

Rest assured

Good planning and a helping hand can help you to avoid these potentially costly mistakes.

Whatever your situation, we’ve seen it all before, and we can help you make the most of it.

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability