Is a government tax grab coming?

Creating a tax plan can seem daunting, especially when difficult times like those we face now usually mean difficult choices.

As the UK faces multiple challenges – with a crippling debt interest bill to boot – it can rely on borrowing from international markets less and less. It seems likely we will start to hear of new tax grabs. Whatever happens, our aim is always to keep your portfolios as watertight as possible.

The slipping halo

Britain’s AAA credit rating used to be something many of us took for granted.

It was not just a sign saying ‘safe bet’ to international lenders but also a source of national pride to many of us.

Then, in 2013, that halo slipped[1]. The international credit agency Moody’s nudged the UK down to Aa1 – second place on a long list leading to ‘default’. The other major agencies followed.

Now, none of them rates the UK as the best type of borrower. What’s more, two of them – Moody’s and Fitch – have slapped a negative outlook on as well, meaning further downgrades could follow.

The lower your credit rating, the higher your borrowing costs. A Fitch report says the UK is now on track to having the highest debt interest costs in the developed world, at 10.4% of revenue[2].

If history is any guide, Westminster and Whitehall will now be looking about raising money from tax.

Parlous public finances

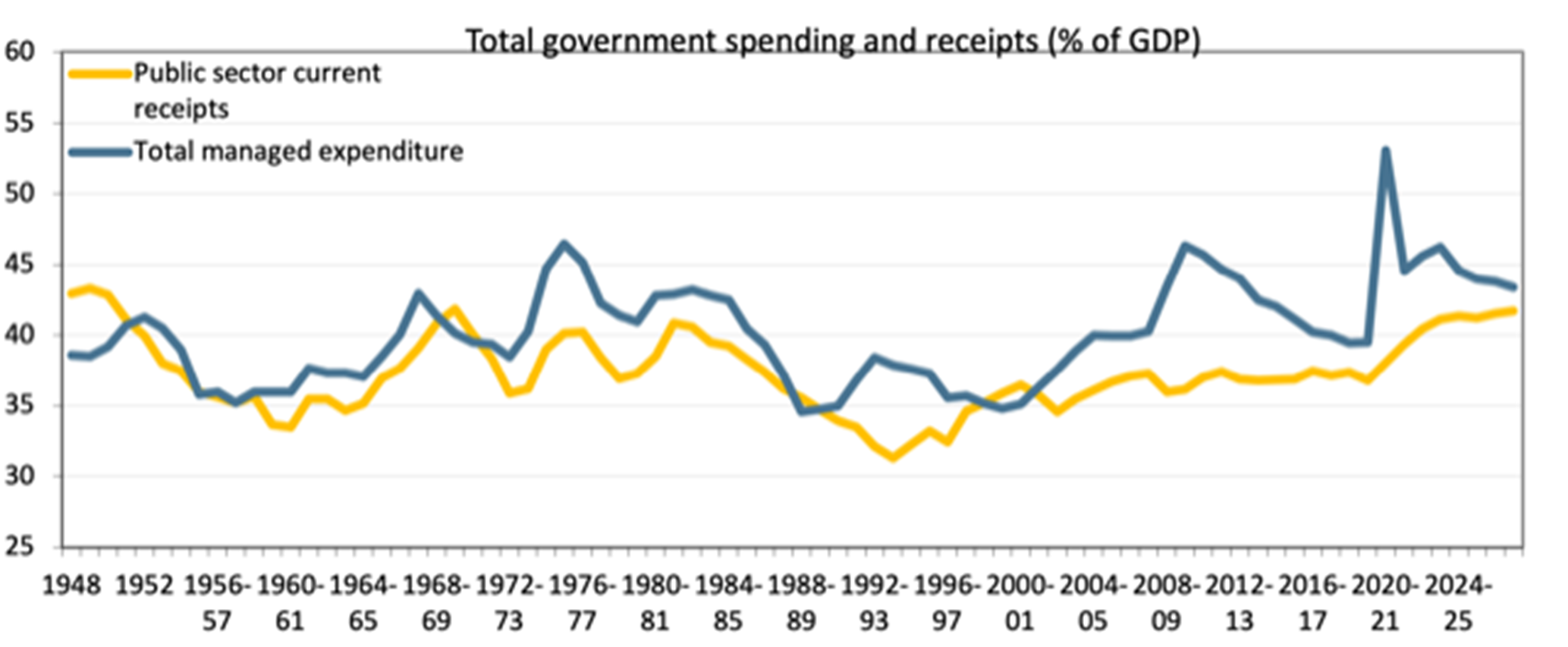

The UK has become quite good at spending more than it earns. The chart below[3] is stark.

While this shows a net deficit of £24.4 billion in Quarter 1 2023 – it also masks the UK general government gross debt of a remarkable £2,537.0 billion, equivalent to 100.5% of gross domestic product (GDP)[4]. We not only spend more than we earn, we owe more than we own.

These are the sort of data that analysts at Fitch, Moody’s and elsewhere assess when they consider sovereign ratings. No wonder the UK is on negative watch.

And no wonder the UK has comparatively high borrowing costs. The chart below[5] shows how much ten leading governments pay to borrow for a period of ten years.

Other borrowing periods provide higher numbers for the UK. In fact, if you’re lending to the UK for just six months, Messrs Sunak and co. will pay you a remarkable interest rate of 5.64%[6].

| Country | Latest yield |

| UK | 4.54% |

| Italy | 4.41% |

| US | 4.29% |

| Australia | 4.19% |

| Spain | 3.71% |

| France | 3.19% |

| Ireland | 3.02% |

| Netherlands | 3.00% |

| Germany | 2.66% |

| Japan | 0.66% |

Difficult choices

But government spending is more likely to go up than down.

The list of items demanding greater investment is long and growing: defence, the green transition, national grid capacity, social services, the NHS, levelling up, water supplies … perhaps even better air traffic control.

Moreover, the UK continues to experience high and rising levels of income inequality. Median disposable income for the poorest fifth of the population decreased by 3.8% in 2022 – while that of the richest fifth increased by 1.6%[7]. Governments will increasingly feel they have to act here and elsewhere.

All roads lead to tax

The direction of travel seems reasonably clear: we’ll be paying more tax.

UK citizens already pay plenty of tax. As a percentage of GDP, tax revenue is around 33%[8]. This is comfortably ahead of strong economies such as the US (23%) and Korea (22%).

But it’s also way behind countries like Denmark (48%) or France (45%). If you are looking to construct an argument that citizens should pay more, then there are always examples to point towards.

What might happen? The tax…

Firstly, the Government might introduce new taxes. They have form. Income tax was brought in to help Britain win the Napoleonic Wars – more than 200 years ago – and it was a smart enough idea to stick around.

If carbon is the modern Napoleon, it would be reasonable to see environmental or energy taxes start to come in. It might even be an easy sell to voters: “brown assets must pay for green assets.”

Secondly, we might see an overhaul of the tax system. You don’t have to be comedian Jimmy Carr to know UK tax is hideously complicated.

In fact, Parliament’s own Treasury Select Committee has called on[9] the Government to address some of the most pernicious aspects of complexity. HM Revenue & Customs itself acknowledges that 105 of the available 1,180 tax reliefs cost the public purse a total of £195 billion. They don’t even know the overall cost![10]

Eat the rich?

Thirdly, the Government might see wealthy individuals as fair game.

Some of the latter are calling for it themselves. A US group called patrioticmillionaires.org, which has sibling groups in the UK and elsewhere, calls for, “reform to our country’s political economy so that it naturally generates greater economic and political equality, the preconditions for a stable, prosperous nation.”

So, just about all the taxes you pay – or are likely to pay – could see some form of upwards modification: income, inheritance, capital gains, corporation. The things you benefit from: ISAs, pension tax relief, venture capital trusts and other schemes may see some downward modification.

It’s probably safe to assume very little is off the table.

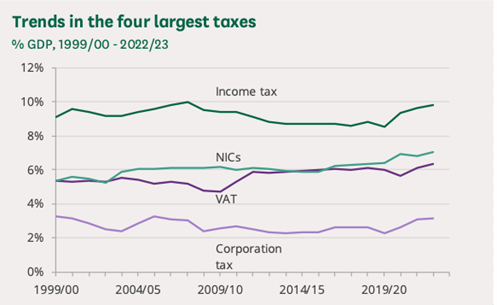

Fourthly, companies might be asked to pay more. Receipts from corporations account for very little of the overall tax pot – as the chart below shows[11].

But, while there might be room to shift this upwards, it is worth remembering that large companies have a good track record of effectively managing and arranging their tax status and affairs. Those amongst them tasked with delivering the green transition might even ask for dispensation in terms of lenient tax treatment.

We have your back

While the likely direction is clear, no one knows the speed or exact end destination.

What we can say is that the UK tax system has for many years allowed for intelligent and sensible tax management. This is a key component of financial planning for wealthy individuals – after all there is no point following the evidence and building a pot of wealth, only for unforeseen leaks to deplete that wealth at the very moment you need it.

Keeping a wealth portfolio as watertight as possible is something we take pride in at First Wealth. Our specialists have been doing it for many years – and will continue to do so, no matter what the future tax system looks like.

[1] http://www.worldgovernmentbonds.com/credit-rating/united-kingdom/

[2] https://www.ft.com/content/b25903fd-2ebe-4f65-aa20-c21d873946f3

[4] https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicspending/bulletins/ukgovernmentdebtanddeficitforeurostatmaast/march2023

[5] https://markets.ft.com/data/bonds/government-bonds-spreads

[6] https://markets.ft.com/data/bonds

[7] https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/bulletins/householddisposableincomeandinequality/financialyearending2022

[8] https://data.oecd.org/tax/tax-revenue.htm

[9] https://committees.parliament.uk/committee/158/treasury-committee/news/196683/treasury-committee-calls-for-action-on-complex-uncosted-and-exploited-tax-reliefs-in-new-report/

[10] https://committees.parliament.uk/committee/158/treasury-committee/news/196683/treasury-committee-calls-for-action-on-complex-uncosted-and-exploited-tax-reliefs-in-new-report/

[11] https://researchbriefings.files.parliament.uk/documents/CBP-8513/CBP-8513.pdf

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability