Is the retirement crisis coming your way?

What’s your retirement number? What’s the specific sum of money you must amass to fund the life you want when you’re older. A recent warning from one of the most respected figures in finance suggests few people will get anything close to their number. This month we look at the problem of not saving enough for retirement (the retirement crisis) – and how to solve for it.

Retirement crisis

“Maybe once a decade, the U.S. faces a problem so big and urgent that government and corporate leaders stop business as usual. We need to do something similar for the retirement crisis. America needs an organized, high-level effort to ensure that future generations can live out their final years with dignity.”

These are the words of Larry Fink. He runs an investment business called BlackRock. It manages around US$ 9 trillion for its clients – roughly equivalent to the combined economies of India, the UK and France.

His point, certainly also applicable to UK, is that medical advances have boosted peoples’ lifespans – but the traditional retirement system hasn’t grown to accommodate it.

I’d say it’s worse than that. The retirement system has not only not grown, but it’s also changed from pension funds that give people a defined benefit (say, 2/3rds of final salary) to one where you must invest for yourself. Governments and companies have effectively said, “you’re on your own.”

People are going to run out of money – and the greatest challenges will fall on younger generations: millennials and Gen Z.

Retirement anarchy in the UK?

Closer to home, some 79% of UK workers have a workplace pension. A dozen years ago it was a paltry 46%.

But it’s one thing to make sure plenty of people have a pension – it’s a very different thing making sure that a pension is big enough.

And that’s the nature of the crisis Larry Fink is referring to, above.

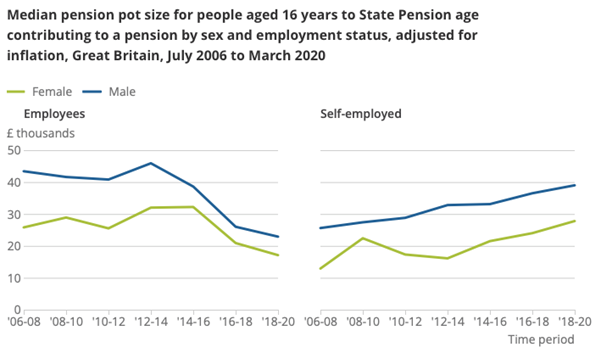

The average pension ‘pot’ isn’t large. The UK government chart below, shows it ranges from the high ‘teens (employed women) up to about £40,000 (self-employed men). It’s hard to make the case that this is anything near enough to rely on.

In fact, some simple calculations fed into the very helpful MoneyHelper pensions calculator show a 50-year-old man with a pot this size could expect an income of about £17,500 a year when they retire.

And this, remember, is the higher end of the bracket. Run the same numbers for a woman, with a pot of £17,500, and the projected annual income is little more than £13,700.

How much is enough?

Of course, if you’re reading this, the chances are you have a considerably larger portfolio, perhaps directed also at other goals, as well as retirement.

In fact, the 10% of wealthiest individuals in the UK have some 64% of pension wealth. This top decile also displays median private pension wealth of £637,000.

The same calculator, with the same data used above (minus any additional contributions to the pension), suggests this could generate an annual income of £45,652.

Would this be enough for your lifestyle aspirations? Don’t forget, this sum is also taxable.

Clearly, these are simple workings – and everyone has unique circumstances – but they illustrate the point that Larry Fink makes: it’s up to you to make sure you have enough to retire on.

I’ll get by with a little help from my friends

Well, you’re not completely alone.

Again, if you’re reading this, you may well know the value of good financial planning. You’re likely to appreciate the advantages of an expert who can assess what you have, what you want to achieve, and then chart a smooth course between the two.

There’s something pleasurable about imagining your future years: how you’ll spend your time, what you’ll do, the things you’ll spend money on, and where you’ll go.

This is an essential part of retirement planning. The clearer picture we can draw of your lifestyle aspirations, the more effectively we can chart the course from your current financial position.

This all leads to ‘Your Number’ – the amount of capital you need to achieve and sustain your ideal retirement. And, equipped with your number as our North Star, we help to keep you on track, and support you once you reach retirement, so you can live life to the full.

With the right planning, it’s very possible to avoid your own retirement crisis.

If you’d like to talk about your retirement planning, please get in touch on hello@firstwealth.co.uk or call 020 7467 2700.

[1] https://www.blackrock.com/uk/about-us/larry-fink-annual-chairmans-letter

[2] https://www.worldometers.info/gdp/gdp-by-country/

[3] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/workplacepensions/bulletins/annualsurveyofhoursandearningspensiontables/2021provisionaland2020finalresults

[4] https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/bulletins/pensionwealthingreatbritain/april2018tomarch2020

[5] https://www.moneyhelper.org.uk/en/pensions-and-retirement/pensions-basics/use-our-pension-calculator

[6] https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/bulletins/pensionwealthingreatbritain/april2018tomarch2020

[i] Assumptions: Born on 8 April 1974, retirement age is 67, pot size £40,000, annual salary is UK average of £37,804 for ages 50-59, annual pension contributions are 10% from employee and 3% from employer, retiree takes the 25% tax free lump sum when available.

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability