Should You Add to Your Property Portfolio?

Some data suggests the housing market may have bottomed. After the turmoil of recent years, one of the UK’s favourite dinner party conversation topics could offer signs of joy again. Rising house prices, more mortgage approvals, and stability in interest rates all offer a much rosier picture than, say, this time last year. But what does this mean for your own property portfolio?

Safe as houses?

Many of our clients own residential properties as part of their portfolio. In fact, the data suggests that you’re more likely to have an investment property than not.

Across Europe, ultra-high net worth individuals own an average of 3.8 homes each[1]. And this constitutes around a third of their total wealth portfolio[2].

And, perhaps, with good reason. In the UK at least, rising house prices have helped focus attention on the property market, far more so than markets in other assets.

Research suggests £100,000 worth of UK property purchased in 1998 would be worth an average of around £454,000 in 2023, before costs[3]. Not bad.

Yet this same research also says that £100,000 invested in the global stock market would have grown to around £631,000. That’s also before costs.

On the up

But it’s hard to deny there’s something about wealthy Brits and housing. It’s a diversifier for a start.

House prices are driven by slightly different factors than, say, the stock market. One thing you’ll never see in shares is the interplay of (low) supply and (high) demand that you get with housing stock.

Renting out a home is also a useful income generator. Residential property yields currently sit at around 5%. This is slightly higher than last year’s 4.8%[4] and quite a bit higher than the FTSE100 dividend yield of 3.9%[5].

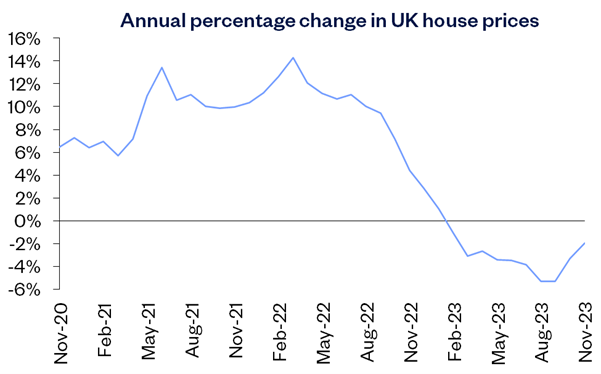

And house prices now, finally, appear to be on their way up again.

They rose 0.2% from October to November, according to the Nationwide’s benchmark survey. It’s the strongest growth since February 2023. This may not seem much but, when you consider the average UK house is now worth nearly £260,000, the numbers start to become meaningful[6].

Source: https://www.nationwidehousepriceindex.co.uk/resources/61i3c-43i85-nn74h-mkp0v-ac5ll

A turning tide?

One swallow doesn’t make a summer – as economists all know. But other data also suggests the housing market may be lifting itself from a trough.

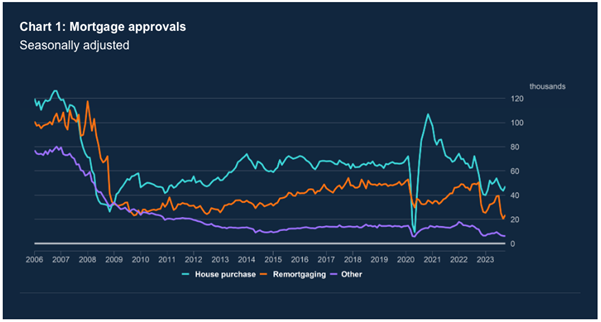

For example, mortgage approvals are up (at least marginally) according to Bank of England statistics this Autumn, shown in the chart below.

And big institutional investors – from banks to pension funds – have a positive outlook on interest rates. They are betting that the current level of 5.25% is a peak and rates will lower to 3.5% in the coming years[7].

This unusually positive outlook must, of course, be tempered. For example, Government house price data suggests a slightly less rosy picture – of a 0.1% drop (September data), not the 0.2% rise cited above (October)[8]. And, with property (or indeed any asset) there is sometimes a risk of illiquidity – a case in which your asset cannot be sold easily and without incurring a loss in value relative to its ‘fair market value’. Though, this can be accounted for with diversification of your portfolio and the building of portfolio resilience in the market cycle.

Sentiment is also key in any market. And what housing market sentiment craves more than anything is stability. Consistent economic policy and interest rates play a key role here. Now the UK appears to have both, the housing market experts Knight Frank expect such sentiment to improve accordingly[9].

Source: https://www.bankofengland.co.uk/statistics/money-and-credit/2023/october-2023

Implications for your portfolio

House prices potentially on the up plus borrowing costs potentially on the way down tends to equal a buyer’s market.

Obviously individual circumstances take precedence, and that’s something we would discuss with you.

Moreover, there are massive regional variations in the UK. A rental property in the Northeast of England could be expected to yield you 7.2%. One in London just 4.7%[10]. Property can be fickle like that – unlike stock markets.

Whatever your thinking, we’re here to help you assess your options – ensuring your wealth is well balanced, backed by sufficient evidence of future potential returns and, most important of all, pointing directly at your targets.

[1] https://www.statista.com/statistics/1031430/homes-owned-millionaires-demi-billionaires-global/

[2] https://www.visualcapitalist.com/visualizing-the-investments-of-the-ultra-wealthy/

[3] https://www.schroders.com/en-us/us/individual/insights/your-house-your-wealth-what-happens-in-an-era-of-rising-rates/

[4] https://www.zoopla.co.uk/discover/property-news/best-buy-to-let-locations/

[5] https://www.fool.co.uk/2023/12/04/heres-how-much-id-need-to-invest-in-dividend-stocks-for-500-a-month-in-passive-income/#:~:text=The%20average%20dividend%20yield%20on,index%20are%20at%20different%20stages.

[6] https://www.nationwidehousepriceindex.co.uk/reports/house-price-recovery-continued-in-november

[7] https://www.nationwidehousepriceindex.co.uk/reports/house-price-recovery-continued-in-november

[8] https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/housepriceindex/september2023

[9] https://www.knightfrank.com/research/article/2023-10-02-new-knight-frank-house-price-forecasts-october-2023

[10] https://www.zoopla.co.uk/discover/property-news/best-buy-to-let-locations/

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability