Staying afloat in Britain’s debt tsunami

The cost-of-living crisis is seeing Britain’s debt levels rise. At the same time, rising interest rates are pushing the price of servicing that debt upwards. While lower income families and individuals are being hit particularly hard, debt is something likely to affect anyone – eroding hard-earned capital.

Drowning in debt

According to Citizens’ Advice, Britain’s debt is a £22bn crisis – that’s the same amount already spent so far on High-Speed 2[1]. The charity goes on to say, “the number of people across the country whose monthly income isn’t enough to pay for their essentials has more than doubled in the last 2 years, from 1 in 20 to 1 in 10 UK households.”[2]

The last debt crisis saw banks overload on risky, often mortgage-backed, loans and some governments teeter on the brink. It didn’t end well.

But this time it’s households.

Government data confirm the grim tale: households in Great Britain owed an aggregate of £1.36 trillion as of March 2020 – up from £1.2 trillion in March 2016[3]. They don’t have more recent information apparently.

Feeding the beast

Higher interest rates have certainly accelerated this debt tsunami.

It was only a few years ago that interest rates sat just above zero. But an almost vertical ascent from there to their current 5.25% – at least at the time I’m writing this – means it’s comparatively more expensive to service that debt.

This is something that affects every borrower. For example, this year, public debt servicing (note, not repayment) will cost the UK Government some £110 billion [4].

Positive signals from the Bank of England – which expects rates to fall to 4.4% in three months, and 3.8% in 18 [5] – are little more than crumbs of comfort.

The effect of high interest rates affects everyone with outstanding debt – although it goes without saying those with a financial safety net are far more comfortable that those without.

Falling house prices

An environment of high and rising levels of Britain’s debt also focuses homeowners’ minds on recent falls in property prices.

Disrupted supply, thanks to the pandemic, a shortage of new homes and other economic fluctuations have all negatively affected the market.

The average UK house is now worth £290,000. That might be higher than a year ago. But it’s comfortably below the peak seen in November 2022 [6].

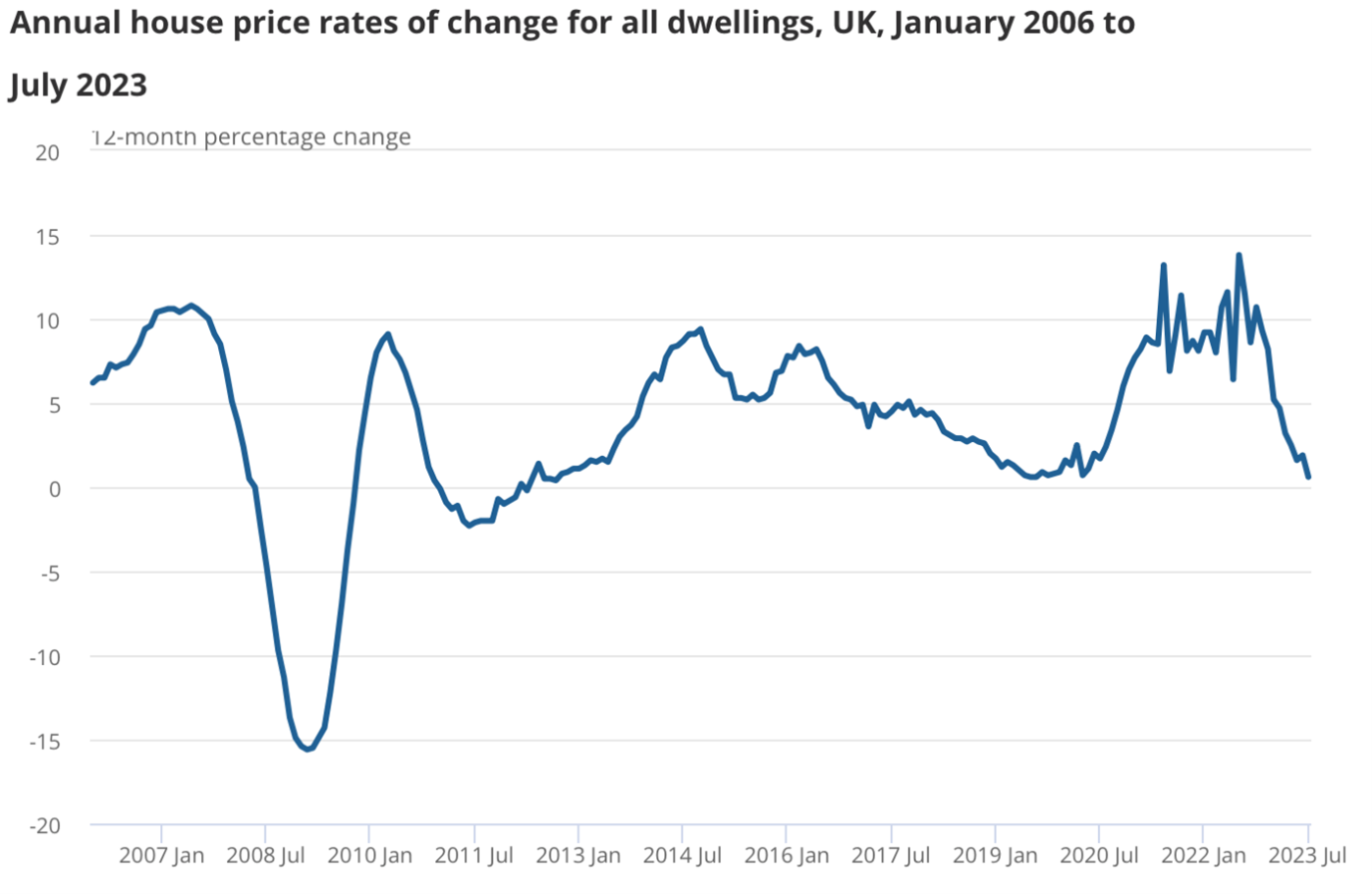

And, for anyone who owned a mortgaged property during the financial crisis, the graph below is taking a direction that looks dangerously like 2008.

At least this negative direction, according to bankers, is unlikely to lead many into negative equity territory. This is where the value of a home falls below the loan taken out against it.

As Santander UK’s Bradley Fordham recently told the Treasury Select Committee, “house price reductions would have a limited impact on negative equity.”[7]

Debt and wealth

Entrepreneurs, wealthy individuals and others with more of a financial cushion are likely to have some debt.

Aside from a mortgage, there are business loans, credit cards, student loans for children and plenty of other possible reasons to borrow.

As tradition dictates, the more creditworthy you are, the more providers trip over themselves to lend. But rates are a far cry from that zero interest rate period after the financial crisis. Get a business loan today and you might be lucky to pay under 10% for it [8].

Sensible financial planning is very much about balancing outgoings, debt, savings, investments, tax liabilities and wellbeing.

And while managing debt might be the most daunting element for some, it’s one of the simpler to address. There are a handful of steps that your advisers will help walk you through.

The Steps

- First is to set establish what you’re spending on. We use sophisticated budgeting software to make this as accurate (and painless) as possible. We’re particularly interested in debt and debt servicing here.

- Second is goal setting. For example, you may find it advantageous to prioritise paying off some debts before others, particularly those with higher interest rates. Or debt consolidation might be an option.

- The key is to get debt into manageable territory. This enables you to, thirdly, to budget for and balance paying off debt with investing. This might include talking to creditors. For example, they might have a preferential repayment plan.

We’ll help you to get debt under control as quickly as possible – enabling your wealth to grow for you, your dependants and, potentially, philanthropic recipients over the long run.

[1] https://www.channel4.com/news/factcheck/factcheck-what-is-hs2-and-how-much-would-it-have-cost-to-reach-manchester#

[2] https://wearecitizensadvice.org.uk/living-on-empty-245f4b9acbe3 and https://wearecitizensadvice.org.uk/debt-time-bomb-countdown-to-a-household-debt-disaster-e596d10996fe

[3] https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/datasets/householddebtwealthingreatbritain, see “July 2010 …” spreadsheet, tab 7.1

[4] https://www.forbes.com/sites/lbsbusinessstrategyreview/2023/07/26/uks-debt-worries/?sh=3768bff533a5

[5] https://capital.com/projected-interest-rates-in-5-years-in-the-uk#:~:text=In%20terms%20of%20the%20UK,to%203.8%25%20in%20Q2%202025.

[6] https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/housepriceindex/july2023

[7] https://committees.parliament.uk/oralevidence/13504/pdf/

[8] https://www.tsb.co.uk/business/loans-and-finance/business-lending-rates/?site=public&d=Any

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability