What does the Ukraine crisis mean for markets

Today, it feels like the world is in a very uncertain place. Russia’s invasion of Ukraine almost seems implausible as we have taken security and peace in Europe as a given post World War II. Other authoritarian states are also flexing their muscles, with China’s ongoing subjugation of Hong Kong with the new National Security Law as a case in point.

The West continues to struggle with what is hopefully the back end of the Covid crisis as populations gather immunity through vaccination and infection, and as new drugs and treatments come online almost daily. Economically, the greatest challenge is soaring inflation, hitting levels not seen for several decades. As a consequence, interest rates and yields on bonds have started to rise and global equity markets have started the year down. That can all feel both gloomy and unsettling.

It is always easy to feel that the present is more uncertain than the past. We have all but forgotten the Armageddon scenarios of events such as the Y2K software bug issues of 2000 (planes expected to fall out of the sky, nuclear power stations to be out of control etc.), the emotional and geopolitical impact of 9/11, or the fear many felt in 2008 when Lehman Brothers failed, and the meltdown of the financial system was a real risk.

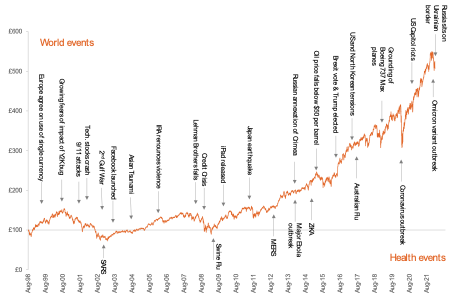

The chart below illustrates that over the mid- to longer-term the markets absorb the consequences of such events and power forwards as capitalism drives the relentless pursuit of profit opportunities. Being shaken out of markets based on today’s news is the worst mistake any long-term investor can make.

Figure 1: Material global events are ever present

Data source: Vanguard Global Stock Index ACC, 4/8/1998 to 14/2/2022 in GBP used as proxy for the performance of global equities. Its use in this chart does not constitute any form of recommendation and is provided for educational purposes only.

What should I be doing?

For an investment perspective the short answer is to do nothing, or if you have additional spare funds, to top up your existing equity investments (buying while stocks are cheap is always a good strategy). All the news that we see and worry about – including the invasion of Ukraine by Russia – is already reflected in market prices. For sure, new news will have an influence on those prices, but by its very definition this is a random process that is hard to benefit from unless you own a crystal ball.

In terms of direct portfolio exposure, it is worth noting that Russia represents around 0.35% of global equity markets, and that is before this is diluted down by any bond holdings in your portfolio. To put this in perspective, the global market weight of Apple is over 4%! In fact, Apple’s cash reserves alone are of a broadly similar magnitude to Russia’s entire stock market capitalisation.

No-one has any real idea as to the wider impact of a Russian invasion, and even when markets fall, it’s worth reminding ourselves that:

- Equity markets often go down – sometimes materially – as part of their journey to delivering positive longer-term returns after inflation. It’s what history tells us, and will always be the case.

- Unless your financial and personal circumstances have changed recently, there is no need for immediate liquidity from your equity positions. Feeling uncertain about markets is not a valid reason for seeking to get out of markets.

- Any high-quality bonds in your portfolio provide several valuable attributes. They provide more stable values, supporting a portfolio against equity market falls, liquidity to meet any liabilities without having to sell equities when they are down and the dry powder to rebalance the portfolio and buy more equities when they have fallen to get the portfolio back up to the right level of risk.

One piece of advice would be to try not to look at the news too much. It can feel unsettling and is increasingly full of sensationalist speculation and hyperbole. Instead, perhaps take a look at a news site that tries to balance out the regular news with positive news stories which tend to be underreported www.goodnewsnetwork.org/category/news/

Of course, if you are still worried, we’re here to talk. Sometimes just talking things through can have a massively positive impact on your state of mind.

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability