Why do some people make the expensive mistake of leaving cash in the bank?

While holding your money in cash might provide some comfort – especially when markets are volatile – stashing too much cash in the bank could do substantial harm to your long-term financial health.

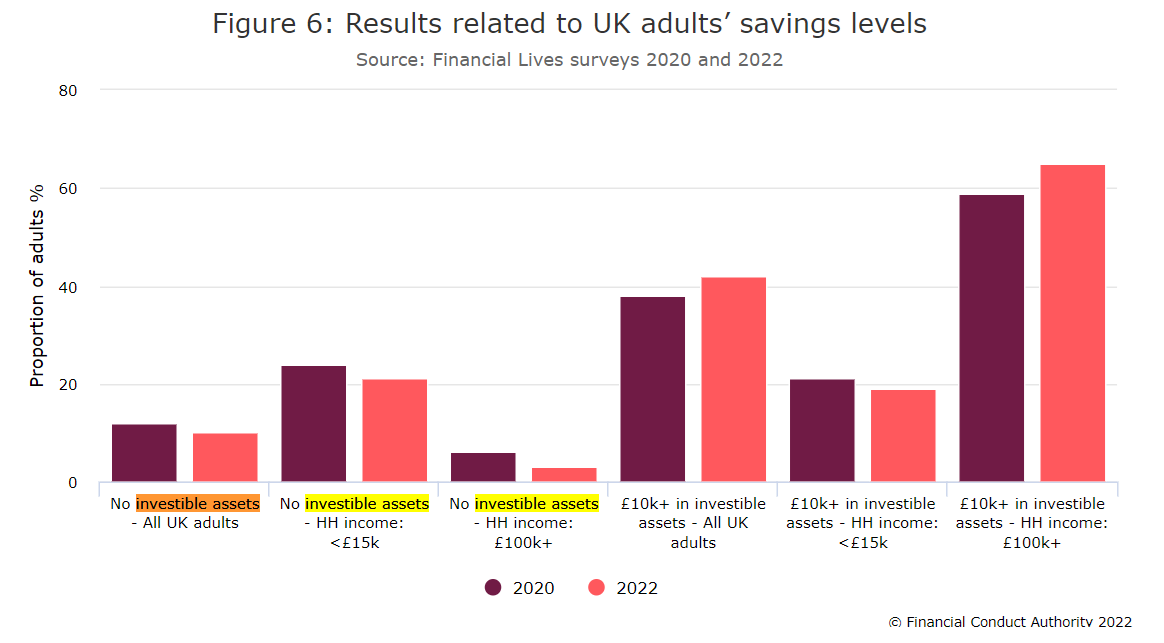

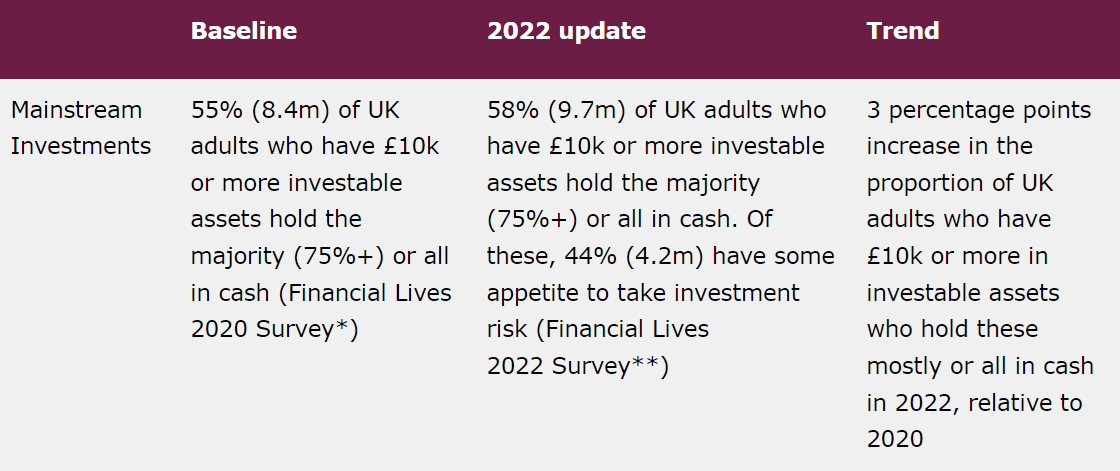

In 2020, data from the Financial Conduct Authority (FCA) revealed that 38% of all UK adults had investible assets of £10,000 or more. Of these, 55% (8.4 million) hold the majority or all of these assets in cash. These statistics have increased. In 2022 the FCA revealed that 42% of all UK adults hold investible assets of £10,000 or more. And, of these adults, 58% (9.7 million) hold the majority or all of these assets in cash.

Source: Financial Conduct Authority, Financial Lives Surveys 2020 and 2022

Source: FCA Consumer Investments Strategy – 1 year update

With current stock market uncertainties caused by the war in Ukraine and the economic turbulence of rising inflation and interest rates, it’s easy to see how some investors may feel safer keeping their money in the bank.

The problem is that cash delivers staggeringly poor returns when compared to investing your money in equities, especially in times of high inflation that we are currently experiencing.

Even the best savings rates struggle to beat inflation

While some easy access savings accounts offer AER rates of 3.55% (Moneyfacts, accurate of April 2023) many accounts pay far less.

With inflation at a 40-year high of 10.4% (as of April 2023), if you’re holding excess cash in an instant access account, your returns don’t have a hope of keeping up with rises in the cost of living.

Even if you manage to find a fixed-rate bond or similar limited access account that pays a higher rate, there’s still little chance that it will keep up with inflation.

The problem with this is that if the returns you get on your savings are lower than the inflation rate, your money is losing value in real terms.

As a client of First Wealth, you have probably already spoken to us about the problems associated with holding too much in cash, especially in the current climate. You’ll also understand the importance of keeping ready cash in an emergency fund.

There is value in keeping cash in an emergency fund

Generally, it’s wise to have between three and six months of net income for a “rainy day” fund. Depending on your earnings, this could add up to a significant sum of money.

Fortunately, cash savings are protected by the Financial Services Compensation Scheme (FSCS) at a sum of up to £85,000 per eligible individual, per bank, building society, or credit union. If you hold more than this amount in any one account and the financial institution holding your funds fails, you could lose everything over this threshold amount.

It’s also worth remembering that large cash savings may also attract tax on the interest you make. There is a Personal Savings Allowance that basic-rate and higher-rate taxpayers can benefit from. However, additional-rate taxpayers don’t have the same privilege and will be charged tax at 45% on any interest earned.

So, while we recommend you keep an emergency fund in an easy access savings account, so you always have available cash should you need it, avoid holding more than you need.

Remember: every penny of cash you hold is just losing money.

No one in their right mind would choose an investment with a guaranteed loss of 8% a year, so why do millions of people still fail to see the folly of keeping cash in the bank?

3 reasons why people might make the mistake of holding their wealth in cash

-

Lack of confidence in the financial system

Trust and confidence in the wider financial system inform financial decision-making at a fundamental level.

Research by the OECD (Organization for Economic Cooperation and Development) found that perceived “risks” in the financial system – such as the risk of digital fraud or a lack of transparency – can undermine people’s confidence in the system.

Of course, this will naturally discourage people from making financial decisions and choosing financial products. The good news is that there are nationwide initiatives, such as the Financial Capability Strategy, that have been established to help find ways to address this problem.

We believe that education plays a big part in the solution and are doing our bit to help. Thrive Money is a First Wealth brand established with the goal to break down the barriers to financial education and help people make sense of their money.

Read more: Thrive Money Goes Live

-

The perceived lack of control when investing in stock markets makes them feel uneasy

Good money management requires a reasoned approach to decision-making and impartial analysis of information. But for those who feel uncomfortable when they are not in control, investing money can be a scary prospect.

Making sound financial decisions isn’t always easy and a volatile stock market can cause increased stress and anxiety.

However, by better understanding the nature of risk, and taking proactive steps to manage those risks when you invest your money, you put yourself in a better position to meet your financial goals.

-

Inability to handle the emotional rollercoaster of the unknown

It isn’t always easy to detach your emotions when you invest. You can rarely predict which way the market will move, and investing can prove to be a rocky ride.

That said, history shows that the long-term view always wins out. Holding your nerve when markets are falling can pay off.

Unfortunately, you can’t enjoy the highs without experiencing a few uncomfortable lows.

Read more: 3 reasons it’s important to detach your emotions when you invest

Many studies have proved that, over time, returns on assets such as equities far outweigh those you see from cash.

There’s a stark difference between holding £100 in cash and investing £100 over the long term

In 2019, Barclays compared the performance of £100 invested in cash, bonds, and equities between 1899 and 2018.

The 2019 Barclays Equity Gilt Study report revealed that:

- £100 invested in cash in 1899 was worth just over £20,000 in 2018

- £100 invested in gilts in 1899 was worth close to £42,000 in 2018

- £100 invested in equities in 1899 was worth around £2.7 million in 2018.

Of course, few of us are likely to want to invest for more than a century, but the same study showed that even with a shorter investment term, equities will still outperform cash.

Also, so long as you remain invested for 10 years or more, history shows that the timing of new investment is relatively unimportant when it comes to enjoying long-term returns.

Useful ways to help expand your financial knowledge and confidence with money

If you need more convincing or want to learn how you can invest your money and enjoy greater potential returns, here are a few suggestions to help you increase your knowledge and experience.

Read:

The Meaningful Money Handbook by Pete Matthew

The Psychology of Money by Morgan Housel

Beyond Greed and Fear: Understanding Behavioural Finance and the Psychology of Investing by Hersh Shefrin

Listen:

Maven Money podcast from Andy Hart

Meaningful Money podcast from Pete Matthew

Watch:

The First Wealth team talk about how much you should keep in cash on Twitter.

Talk to an expert

Financial coaching can help you work through your worries and build a better relationship with money. With the right coach by your side, the process should empower you to remove the barriers in your way and help you find financial success through healthy goal-setting and personal growth.

Get in touch

At First Wealth, we understand that emotions and money are integral to one another. If you’d like to find out how we can help you overcome emotional barriers and preconceived ideas so that you can maximise your wealth and reach your long-term financial goals, please get in touch.

Email hello@firstwealth.co.uk, book a video call, or phone us on 0207 467 2700.

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability