Are changes to tax-efficient investing afoot?

When Chancellor Jeremy Hunt presents his Autumn Statement to Parliament on 22 November 2023, pundits say we should expect changes to tax-efficient investing and saving. Is now the time to start making the most any allowances you have left, lest they are pruned by future legislation?

The History

Westminster and Whitehall are leaky vessels. In 2016, George Osborne’s entire budget ended up in the hands of the Evening Standard newspaper [1]. The Cabinet Secretary’s letter warning against leaks was itself leaked just three years later [2].

Life so often imitates art: “I’ve been leaking my whole life,” boasted hapless adviser George Cullen in the 2005 political sitcom The Thick of It [3].

As I write, leaks coming from government and other sources focus on possible changes to ISAs and, potentially, tax efficient investing and savings more broadly. Pundits suggest any changes could be announced in this November’s Autumn statement.

It’s Successful Anyway

ISAs, or Individual Savings Accounts to give them their proper name, are a rare political decision that looked beyond the ballot box. Launched in 1999, they’re now a staple of many people’s long-term financial planning and tax efficient investing and saving plan.

They’ve evolved over the years but there are now four types:

- cashISAs – typically bank or building society savings accounts

- stocks and sharesISAs – for shares, bonds, trusts and funds

- innovative financeISAs – peer-to-peer and crowdfunding investments

- lifetime ISAs – designed more for home purchases or retirement

You can invest up to £20,000 in an ISA each tax year, though specific rules apply to specific ISA types.

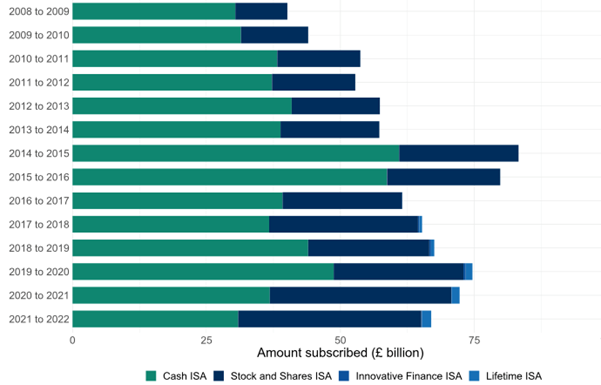

They’ve proved successful and popular, as the below chart shows. As of June 2023, more than £740 billion was held in ISAs, with an average market value of £29,387.

Number of Adult ISA accounts subscribed to during the financial year [4]

ISAs in scope?

Surely it would be reasonable to expect any government to only enhance such a popular and successful idea, rather than degrade it?

We wrote recently about the possibility of a government tax grab – and in these strange times perhaps we should expect the unexpected.

But the chat coming from HM Treasury and investment industry sources appears to be about encouraging more ISA investment, not less. Some ideas that have been doing the rounds are:

- Remove barriers to UK stock market investing – perhaps with a specific allowance for home-grown companies.

- Blend cash ISAs with stocks and share ISAs – although the vastly different risk profiles of the building society account and mutual funds that make up each respectively must be considered.

- Simplify a complicated landscape – might we expect changes to the Innovative Finance and Lifetime ISAs? The chart above shows consumer take up is limited.

What we do know is that Jeremy Hunt spent some time this summer urging big pension schemes to invest in UK companies, to help stimulate the national economy[5].

November’s autumn statement may see a similar message directed at wealthy individuals.

A rich tax-efficient savings landscape

ISAs may be the cornerstone of tax-efficient savings – but they’re not the whole house.

There is little suggestion today that other tax-efficient vehicles might be in scope for changes but, as always in politics, no one knows. When future changes are afoot, it is always worth checking you have made the most of the existing allowances you qualify for.

These include (but are not limited to):

- Pension savings

- Child trust funds and junior ISAs

- National Savings and Investments

- AIM ISA

- SEIS

- Venture Capital Trusts (VCT)

- Enterprise Investment Schemes (EIS)

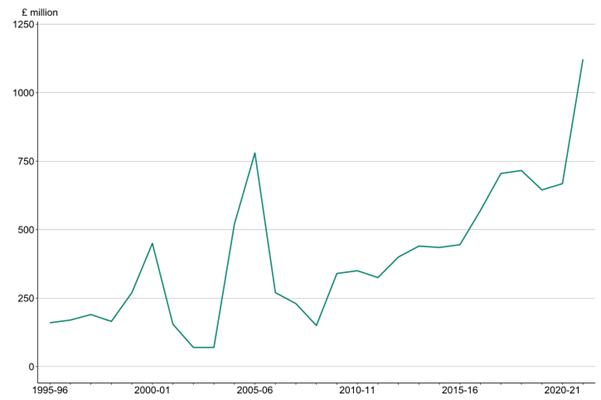

The latter two are particularly interesting. VCTs are designed to help smaller, higher-risk trading companies raise finance, often from wealthy individuals. They’re growing in popularity too, according to the below government data.

Amount of funds raised by VCTs (£ million), 1995-96 to 2021-22 [6]

EISs are broadly similar, in that they aim to direct capital to small and fast-growing companies, rewarding the investor with tax relief. It is worth noting that both EISs and VCTs have detailed and specific rules, and investment risks can be comparatively high.

Going back to what we might expect on 22 November, if the goal is to encourage more people to invest – and invest specifically in UK companies – It would be reasonable to expect positive change.

But we don’t have a crystal ball, and it is always worth speaking to your adviser about whether you are making the most of the tax-free options available now.

[1] https://www.theguardian.com/uk/2013/mar/20/budget-leak-uncanny-echo-dalton

[2] https://news.sky.com/story/leak-inquiry-into-leaking-of-letter-warning-about-leaks-10684561

[3] https://www.quotes.net/mquote/930181

[4] https://www.gov.uk/government/statistics/annual-savings-statistics-2023/commentary-for-annual-savings-statistics-june-2023#:~:text=The%20median%20ISA%20holder%20(by,in%20average%20ISA%20savings%20values.

[5] https://www.gov.uk/government/news/chancellors-mansion-house-reforms-to-boost-typical-pension-by-over-1000-a-year

[6] https://www.gov.uk/government/statistics/venture-capital-trusts-2022/venture-capital-trusts-statistics-2022

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability