Quantitative easing: What is it and how does it affect my investments?

Quantitative easing (QE) is a monetary policy tool used by central banks to pump money directly into the economy, usually by purchasing government bonds.

When an economy is slowing down or heading towards a recession, central banks will cut interest rates to reduce the cost of borrowing and encourage investment. But when interest rates have no place left to fall, QE is used to help stimulate spending, investment, and growth.

Quantitative easing is the last resort to stimulate the economy

Generally, QE is regarded as a last resort to stimulate spending in the economy when low-interest rates fail to generate consumer spending.

Although QE is often described as “printing money”, in fact, no fresh bank notes are made.

Instead, the bank buys government bonds – a type of investment that is basically lending money to the government. In return for this money, the government promises to pay interest on the loan and repay a certain sum of money in the future.

QE pushes interest rates down, which makes it cheaper for everyone – businesses and consumers – to borrow money.

This is how QE works in practice

The Bank of England purchases government bonds from other financial companies and pension funds.

In doing so, the price of the bonds tends to rise, so the bond yield, or interest rate, that bond holders get goes down.

The lower interest rate on UK government and corporate bonds filters through the economy to lower interest rates on loans for consumers and businesses, which helps to boost spending and keep inflation in check.

When did QE become a thing?

QE was first used in the UK in 2009; at the height of the financial crisis, when stock markets were in freefall; the economy was under serious threat and unemployment was climbing.

Since that time, the Bank of England has launched QE programmes following the eurozone debt crisis, the Brexit referendum, and, most recently, during the coronavirus pandemic.

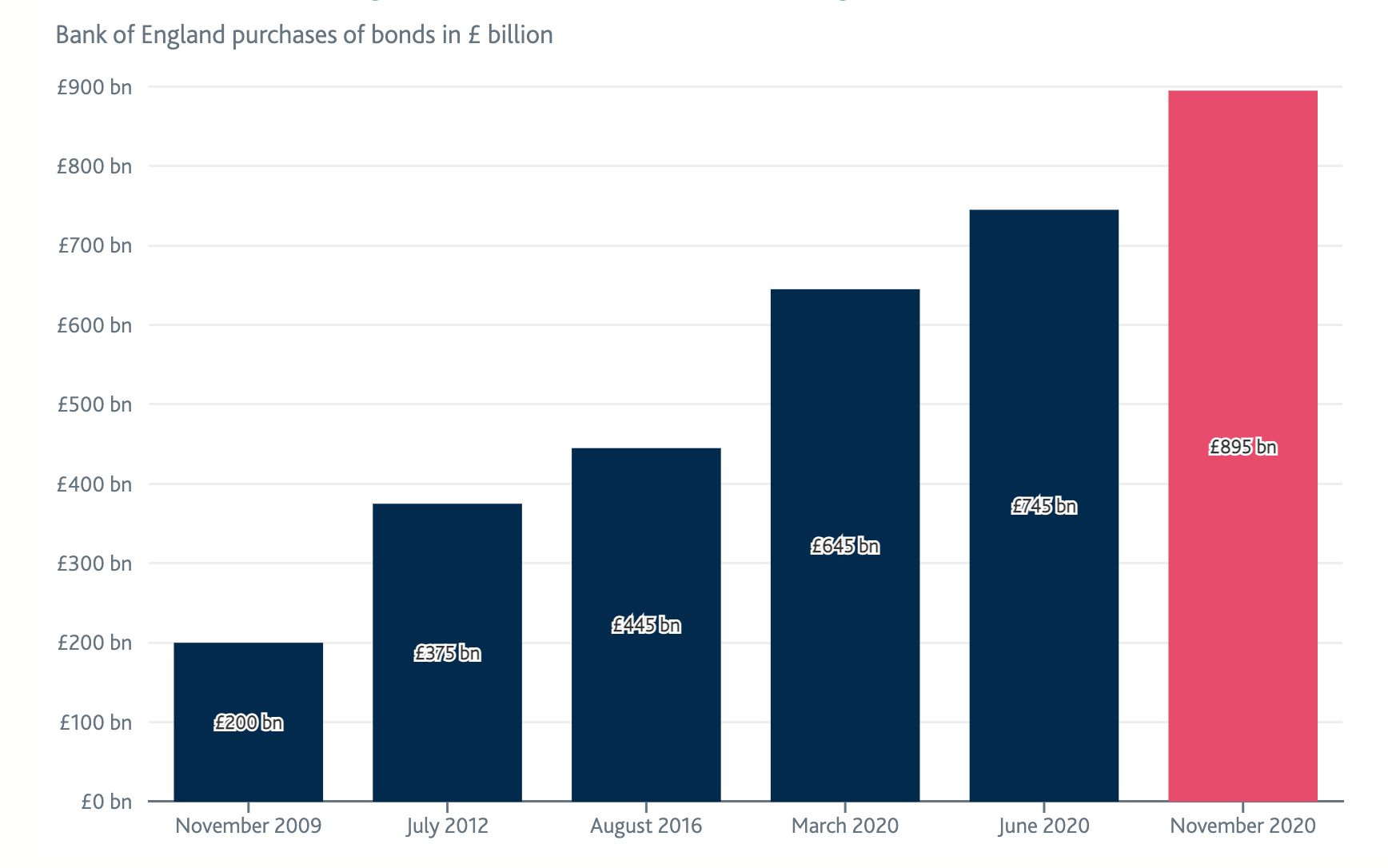

The chart below shows how the Bank of England has been increasing the amount of quantitative easing.

Source: Bank of England

The UK wasn’t the only country that adopted the idea in 2009. The eurozone, Japan, and the US also started their own QE programmes during the same period.

How have other economies responded to Covid-19?

The global pandemic has hurt us all. And many central banks have doubled down on QE.

The Telegraph reported that, in November 2020, the Bank of England had approved almost £100 billion of asset purchases. Compare this to:

- The European Central Bank (ECB) – £1.4 billion, on top of an existing 18-billion-a-month programme

- America’s Federal Reserve – £541 billion

- Sweden’s Riksbank – £43 billion

- The Bank of Canada – £3 billion a month

Almost £900 billion has been pumped into the British economy

The substantial increase in QE measures during the pandemic crisis has alarmed many.

In July, the House of Lords issued a report from the economic affairs committee – of which Mervyn King, former Threadneedle Street governor, is a member – saying that the Bank of England risks becoming addicted to creating money.

“QE is a serious danger to the long-term health of the public finances. A clear plan on how QE will be unwound is necessary, and this plan must be made public,” said Lord Forsyth, the committee’s chairman.

Quantitative easing in the UK is now around 40% of GDP

The 68-page document warns that the Bank of England should come clean about how it expects to unwind its £895 billion QE programme. They also expressed concern that QE could lead to higher inflation and cause further damage to the government’s finances.

The Lord’s economic affairs committee stated that the Bank of England had become too dependent on using QE. They also warned that it was at risk of widening the wealth gap by boosting asset prices.

The Lords committee report warned that “the scale of the increase in asset purchases by the Bank in 2020/21, and the consequent rapid increase in broad money, has fuelled concerns that inflation may start to pick up faster than the Bank currently expects.”

What does all this mean for my investments and long-term wealth?

While QE is supposed to be an excellent way to improve spending and investment and meet the government’s 2% inflation target, there are concerns that the effect on asset prices can lead to more risky behaviour and can create speculative bubbles.

As already mentioned, there is an argument that quantitative easing favours the wealthy who hold shares, property, or bonds, because it can boost asset prices.

The hope is that this increase in wealth for businesses and households should make people more likely to spend, and therefore boost the economy.

The biggest concern with this latest round of QE is that, in effect, its funding payments being made to households through the furlough scheme, for example. So, the money being poured into the economy has a direct route into the real economy. Whereas, in 2009, the money was routed into the financial markets.

This could cause a further increase in inflation.

The thing we should perhaps be most concerned about is the cost to the taxpayer over the medium to long term.

An evidence-based investment approach protects and grows your wealth

Throughout the coronavirus pandemic, there have been alarming headlines about the economy and the effects on the markets.

Daily commentary on market news can challenge your investment discipline and stir anxiety about the future and your investment strategy.

Evidence-based investing takes a long-term perspective and provides a disciplined approach to constructing your investment portfolio.

This is the approach First Wealth takes with every client.

We work to create wealth by capturing the returns of the entire market, driving down costs, and removing the emotional decision-making of a “beat-the-market” mindset.

However you feel about how the British government and Bank of England are handling the current crisis, it’s important to keep a long-term view and avoid getting caught up in the hype.

We always keep an open mind and will be guided by the academic research available and take the approach that aligns with your financial goals.

If you’d like to discuss the current state of the British economy and how you can invest for long-term growth, get in touch. Email hello@firstwealth.co.uk or call 020 7467 2700.

Articles on this website are offered only for general informational and educational purposes. They are not offered as and do not constitute financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability