Whatever happened to emerging markets?

Emerging markets are the darlings of investment world – with superior growth, better economic data, and pleasing returns. Right? Well, a difficult pandemic and a flat journey out of it might suggest otherwise.

We have no ability to see into the future, but what we know is that a small allocation to the long-term returns historically displayed by emerging markets is often a sensible approach.

What are emerging markets?

“There is no official definition of an emerging market,” says the International Monetary Fund, somewhat unhelpfully [1].

This much respected organisation admits that the main ‘advanced’ economies (like the UK, US, France, and Canada) tend to have high per capita income, export diversified goods and services, and are well integrated into global finance.

Further down the list on these criteria are ‘emerging market’ economies.

Setting aside economic jargon, ‘emerging market’ economies are countries with promise and good prospects for future growth.

China is the biggest emerging market by far. Its economy is second only to the US in size. But it’s termed an emerging market partly because of its relatively limited access to the global financial system.

Much promise …

China has certainly offered investors growth.

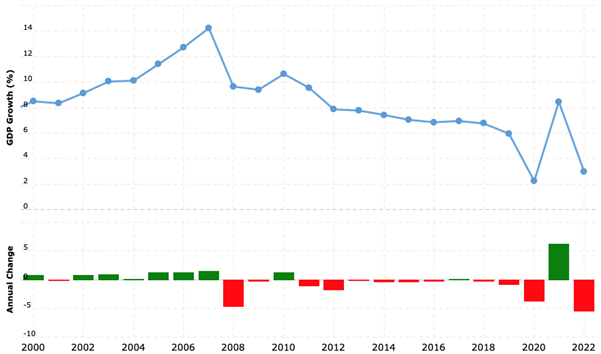

As the chart below shows, 2019 was the first year this century in which its economy didn’t grow by more than 6%. Even in the great financial crisis it was expanding at almost 10% a year!

Remarkable long-term Chinese growth [2]

Other markets did well too. India achieved a compound annual growth rate of 5.5% in the 2012-2022 period. Turkey was 5.3%, the Philippines 4.9%, Egypt 4.2%, Malaysia 4.1%.

It was a golden period for emerging markets – thanks to low interest rates, rising living standards and investors in the west looking for better returns than those available on domestic investments.

… little delivery?

But the pandemic wasn’t kind to up-and-coming economies across the board.

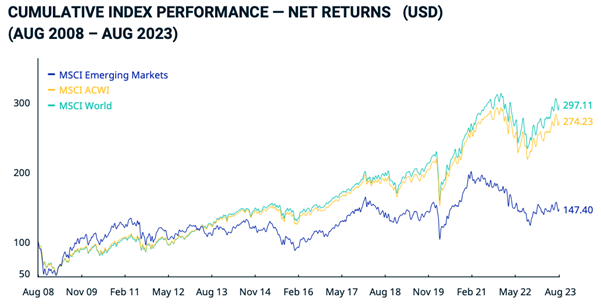

The chart below shows one of the main emerging market indices plotted against two indices that track the world’s companies. For the avoidance of doubt, the amber line marked ‘ACWI’ includes companies in both developed and emerging markets, the light blue line marked ‘World’ is for companies from developed markets only.

Had you invested in emerging markets as Covid-19 started to grip the world, you’d have got your money back at best.

This is because all that appetite for riskier investments in far flung corners of the world has ebbed somewhat. The Chinese property market, a staggering 30% of the country’s economy [3], had gorged itself on debt – before suffering the dreaded but inevitable hangover.

Add in higher inflation, rising interest rates – and of course war in Ukraine – and you could be forgiven for wondering if emerging markets might lose their lustre.

Emerging markets lag both the World and All Companies World Indices [4]

An evidence-based approach

If you know our approach at First Wealth, you’ll know we are proponents of evidence-based investing.

This means following what empirical, academic evidence says about the optimal approach to managing money. It’s why, for example, we use passive funds rather that active. Over time the latter tend to disappoint, especially once their higher fees are factored in.

In emerging markets, the evidence tends to suggest there is no direct link between the performance of an economy and its stock market[5]. A study shows that, between 1996 and 2019, Argentina’s economy grew 1% and its stock market declined 1.5% (after inflation) a year. The data for Mexico are 1.2% and 5.8% respectively. China is 8.4% and 5.5%. Chile is 2.7% and 3.4%.

What these 23-year numbers also demonstrate is consistent above-inflation returns. And this fits the narrative – or the received wisdom – of emerging companies as up-and-coming investment opportunities.

At First Wealth we recognise this long-term, empirical evidence. We tilt client portfolios towards global investment opportunities and, within that, towards emerging markets.

That’s simply because the long-term evidence says it’s the sensible thing to do.

[1] https://www.imf.org/external/pubs/ft/fandd/2021/06/the-future-of-emerging-markets-duttagupta-and-pazarbasioglu.htm

[2] https://www.macrotrends.net/countries/CHN/china/gdp-growth-rate

[3] https://www.barrons.com/articles/china-broken-property-market-a0a851b4

[4] https://www.msci.com/documents/10199/c0db0a48-01f2-4ba9-ad01-226fd5678111

[5] https://www.evidenceinvestor.com/gdp-growth-and-emerging-market-returns/

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability