5 ways financial planning provides value for money that you may not have considered

As a business owner, professional, or entrepreneur, you will be familiar with the concept of “value”. You’ll also be aware that sometimes the true value of the goods or services you’re receiving can be difficult to see. Because of this you can end up focusing on the amount you’re spending, rather than the real value being provided. This is especially true when working with financial planners. However, research from Vanguard reveals that the value provided by a financial adviser is 3% over and above investment returns. At First Wealth, everything we do is about ensuring our clients receive real value for money, both in terms of the advice provided and your money’s growth potential. Read on to discover five important ways that First Wealth’s planning achieves this.

1. Evidence-based investing

Given the volatility of the stock market and global economy in 2022, it may seem logical to place your money into an investment portfolio that’s looked after by a fund manager. While it costs more, you may take comfort knowing that someone is making decisions on which companies your money goes into, and when to buy and sell equities to maximise potential growth.

This in turn could help you beat the market. The only problem is that evidence strongly suggests this is typically not the case. Indeed, research carried out by S&P’s financial research company SPIVA measured the performance of actively managed funds against their passive counterparts.

Passive funds use computer algorithms to track stock market indexes, such as the S&P 500, and seek to minimise costs by limiting the number of trades performed.

S&P’s renowned SPIVA research looked at the performance of global markets over 1, 3, 5, 10, and 15 years. According to their findings, over a 15-year period, only 10.62% of the active managers outperformed the S&P 500.

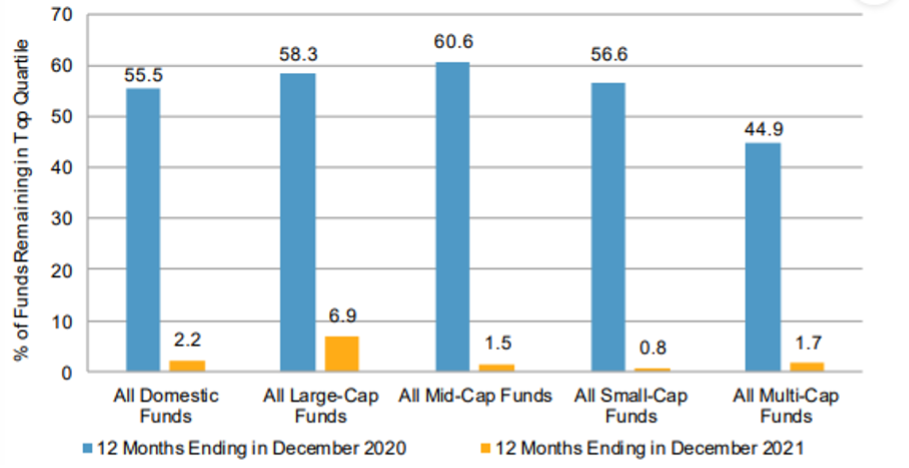

Furthermore, the research found that, over a 5-year period, only 3.5% of the S&P Dow Jones’ largest companies remained in the top quartile over an extended period.

This suggests that when a company did perform well it was typically short-lived.

The illustration below, which looks at the performance of the top quartile funds on the S&P 500 in 2019 through to December 2021, echoes this.

Source: S&P 500 Dow Jones Index

This makes for sobering reading, especially if you are paying higher fees in the belief that a fund manager will provide greater growth potential.

This is why, when it comes to investment management, we take an evidence-based approach.

An evidence-based investment approach weighs the real performance of actively managed funds against passive funds, which can then be used to provide strategies that are more likely to deliver better portfolio results.

To demonstrate why we believe evidence-based investing works, you might want to consider the following example. When one client asked us how his investment portfolio had performed, we were able to demonstrate that it had grown from just under £1.5 million when the pandemic hit in March 2020 to almost £1.9 million two and a half years later – an increase of more than £400,000.

2. Financial coaching

As humans, we learn to deal with events in certain ways, which can result in us making decisions based on pre-established assumptions that are typically driven by emotion.

These “behavioural biases” can result in you making a spontaneous decision you may later regret.

A common example of this is “loss aversion”. This is when you experience an overwhelming desire to avoid losses, often resulting in people selling their investments during a stock market downturn. This emotional response can result in depriving the investment of any chance to recover, and potentially grow, as and when the stock market later bounces back.

In 2022, the stock market has remained volatile, and developed nations have seen soaring inflation and rumours of a global recession – thanks largely to the Covid pandemic and the war in Ukraine.

As a result, you might be tempted to sell your investments and put the money into cash savings. Doing this would almost certainly produce negative returns for your cash when the corrosive effects of inflation are taken into account.

Read more: Why do some people make the expensive mistake of leaving cash in the bank?

With financial coaching, we help you understand why this, and other emotionally driven decisions, are likely to be choices you’ll end up regretting, and could significantly reduce the value of your wealth.

3. Ensuring your money is tax-efficient

Tax efficiency is another important element of the broad range of issues we discuss with clients to ensure the best outcomes.

This could include protecting your pension pot from a Lifetime Allowance (LTA) charge, which could be as high as 55%, or helping reduce your exposure to Inheritance Tax (IHT).

After the former chancellor, Rishi Sunak, froze several tax breaks and allowances until 2026, the possibility of an increased tax charge could be greater than ever.

With our extensive knowledge of tax planning, intergenerational wealth strategies, and trusts, we could help reduce or negate any exposure to both.

Additionally, we work with you to maximise the tax benefits of your pensions while reducing any exposure to Income and Capital Gains Tax, as well as any other tax you might be liable to.

4. First Wealth delivers value for money

With the cost of living crisis, you might be asking yourself: “how much am I paying for what I’m getting and does that represent good value or not?”

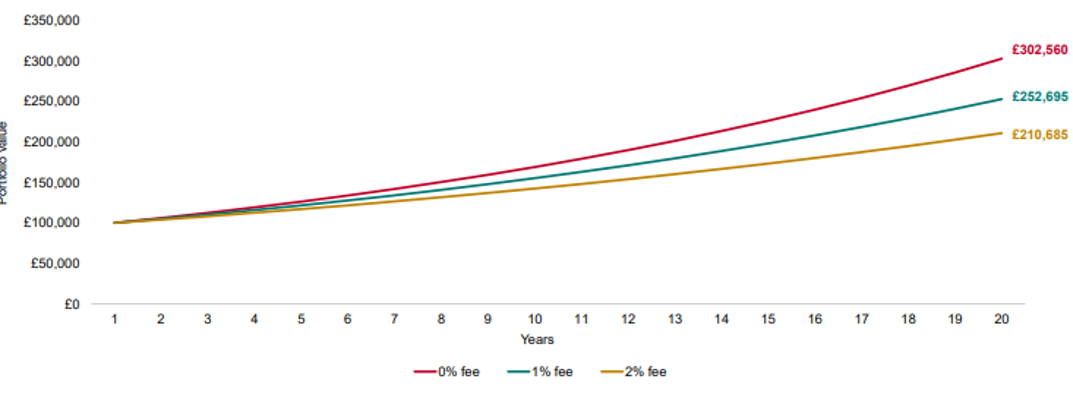

It’s an important point, as the costs associated with your investment could significantly reduce any growth your money has enjoyed.

To demonstrate this, you might want to consider the following illustration, which shows the compound effects of a 0% fee, 1% fee and a 2% fee on a £100,000 investment.

The illustration below, which represents research carried out by Vanguard, assumes an average growth rate of 6% over 20 years and is not representative of any actual investment.

Source: Vanguard

As you can see, if you are paying 2% charges, the value of your investment will be more than £90,000 lower after 20 years than someone paying no fee. Worse still, these charges are significantly lower than other investment companies, some of which charge 4% on an initial investment.

The good news is that First Wealth’s fees are reducing, even though everything seems to be rising in price.

We have negotiated a reduced charging structure with our main platform provider, Fusion Wealth, which means even greater potential returns for you on your investment’s growth.

5. Excellence is the cornerstone of what we do

Next year, the Financial Conduct Authority (FCA), the industry regulator, is introducing a new Consumer Duty, which will provide strict rules that all advice firms will have to follow.

Designed to ensure that consumers are properly protected, the Consumer Duty is set to improve standards across the financial services industry. Briefly, the areas the Duty will cover include ensuring that clients receive good value, communications they can understand, and products and services that meet their needs.

While this is clearly good news for all consumers, at First Wealth these things have always been at the heart of everything we do for clients. This means you will not have to wait for the new rules to come into effect to receive these benefits, as they are fundamental to what we have always delivered to our clients.

Get in touch

At First Wealth, we care about looking after and growing your wealth. If you’re concerned about how the current state of the markets may be affecting your investments or want to learn more about how we can help you maximise your wealth and reach your long-term financial goals, please get in touch.

Email hello@firstwealth.co.uk, book a video call, or phone us on 0207 467 2700.

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

This document is marketing material for a retail audience and does not constitute advice or recommendations. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Let's Talk

Book a FREE 30-minute Teams call and we’ll answer your questions. No strings attached.

Check Availability